As Good As It Gets?

Happy New Year and Welcome back!

New Year. New Market.

A predictable one so far:

Dec 27th: "10Y hitting my 3.8% target so I fully expect a bounce beginning of new year."

Today we saw the coordinated bounce in USD and yields providing the headwind to equities and bonds.

It just so happened to be the worst drop in tandem for stocks and bonds to start a year in more than 2 decades.

About that yield call. Dec 17th:

I have 3.8% potential overshoot - and it is CRITICAL LEVEL.

Basically, the trend higher in yields is broken if we get and stay below 3.8%. PERIOD

For now, this is just a bounce, and just because DXY & 10y are bouncing off technical support, doesn't mean equities fall apart.

For that we just need continued selling in MAG7.

About That Mag7 Performance!!

Recent headlines:

Nasdaq 100 soars 53.8% in 2023 for best year since 1999!

Magnificent 7 hit a fresh All Time High. Now up 109% for 2023.

The Magnificent 7 have a higher weighting in the MSCI World index than all of the stocks in the UK, China, France and Japan combined.

The Big 6 are set to add $4.83 trn of market cap in 2023 – that amount ‘added’ is larger than the current nominal GDP of every country not named the US or China ..(GS)

Here was my call Nov 17th:

Tech Concentration Risk is now starting to look a lot like the run-up in 1999.

The big difference is the BIG MONEY is even bigger and chasing tech stocks with other BIG MONEY: "BlackRock’s model portfolios have about $100 billion tracking them. Salim Ramji, global head of iShares and index investments at the firm, predicted in July that the overall industry could grow to $10 trillion over the next five years, from about $4.2 trillion." BloombergGeoffrey at @GraphFinancials has a solid point:

"Betting on stocks going down nominally in fiscal dominance is risky."

Just so happens, SPX finished the year with 9 consecutive green weeks - its longest winning streak in 20 years.

Earlier on Nov 8th I had also posted:

realized vol is coming down which is driving systematics to bid like it’s 1999.

Fundy’s think it’s earnings. Macro wonks say Yellen kicking the can. Technicians excited about the 50D. And Sentiment folks credit ‘seasonality’.

Flows over Macro

So here we are again, tracking every move they make looking for The Top.

Clients know I have some intermarket analysis tells that have NOT triggered yet to confirm or deny them the 1999-esque run.

For now, todays selling is much more a case of 2023 winners getting sold - as warned - and oversold laggards/value and safety/defensives catching a bid.

See my Growth-to-Value Rotation chart? I've been expecting 1.8 ratio to get hit and we got it today.

The Bullish Backdrop, Still.

Bulls still defend their bias bent for further (maybe even explosive) upside given decelerating inflation and Fed easing will keep real yields low, at the same time they believe rising nominal GDP and strong labor market will support spending so as to avoid/delay recession.

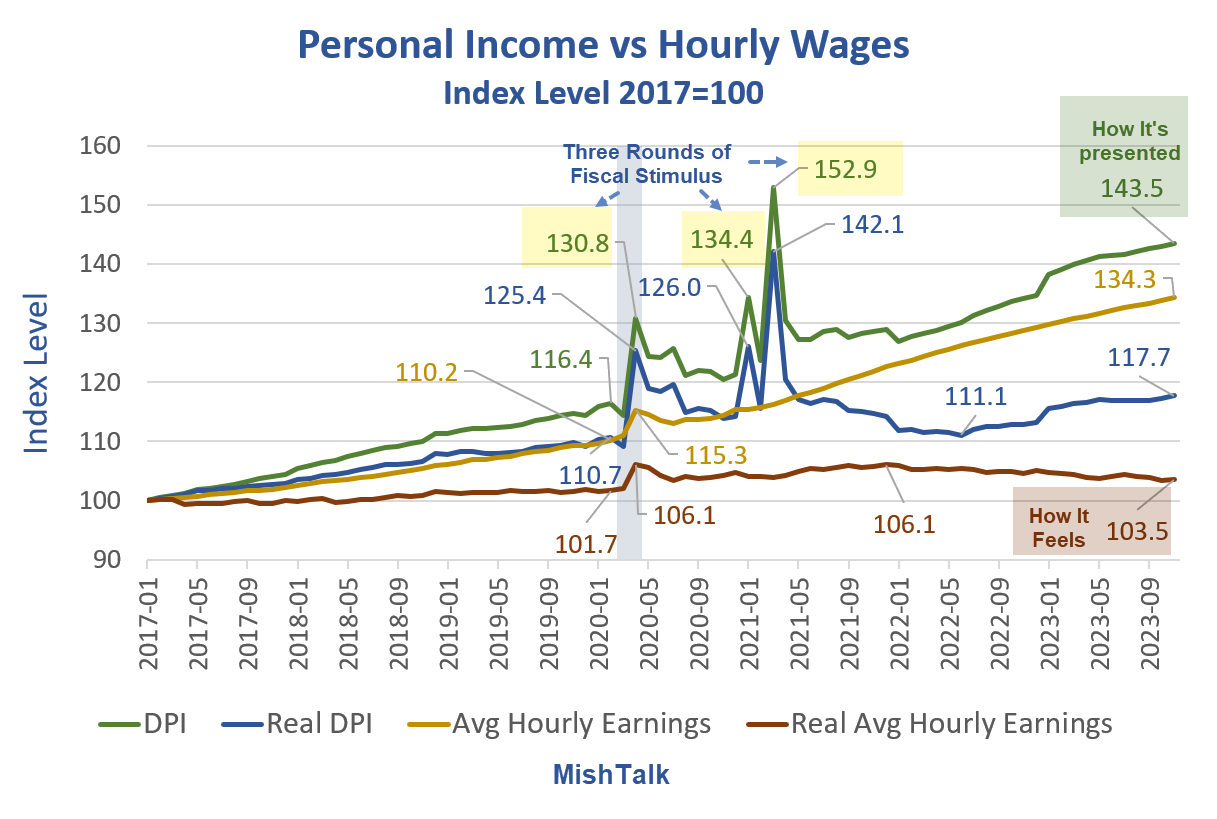

As wages continue to rise:

Nearly half of all U.S. states and the District of Columbia will increase their minimum wage in 2024.

H/t CNN

The problem with that is:

"Although wages are up 21.9 percent in nominal terms, real wages are down 2.5 percent in the last two years."

H/T @MishGEA

My baseline bet continues: “Wage Inflation Delayed Recession”, so we need rising jobless claims above 267K to introduce economic volatility that will trigger stock market volatility.

And despite this, the fed futures rate market is pricing in rapid and deep cuts.

But if the economy is so anti-fragile, why cut at all?

Anyway, analysts are optimistic about S&P 500 earnings growth in 2024 - expecting 11.1% overall growth in 2024 despite rising just 3.1% in 2023. Maybe Q4 earnings season will delight.

Regardless, guidance and earnings better materialize soon to support higher-than-average valuations in stocks, which are at 19.8 times forward 12-month earnings estimates. The long-term average is 15.6.

Flows Over Fundamentals

Quant flows, or systematics, have been in bullish buying mode post "Fed Pause" and "Yellen Yahtzee" Nov 1st. Here's a random grab-bag of stats related to fund exposures I collected in my travels today:

GS PB Gross exposure: 100th percentile on a 5-year lookback

Bull:Bear Sentiment: Near 7-year highs

Non dealers exposure in US equities: At the highest levels since 2020 after the biggest short covering rally since Nov 2021.

CTA length in S&P: Above 90th percentile - with projected CTA flows showing ~200Bn to the downside in a strong tape of derisking.

Year-end 'window dressing' for client statements and performance incentives that spurred FOMO by fund managers, has now largely abated.

*Max* Long (SPX) Gamma will finally roll off. We've seen one of the largest one week declines in gamma in our database. We're through 2023 expiries and 2024 gamma is no longer Max Long. The rest of the long gamma exposure should clear by January monthly expiration." GS

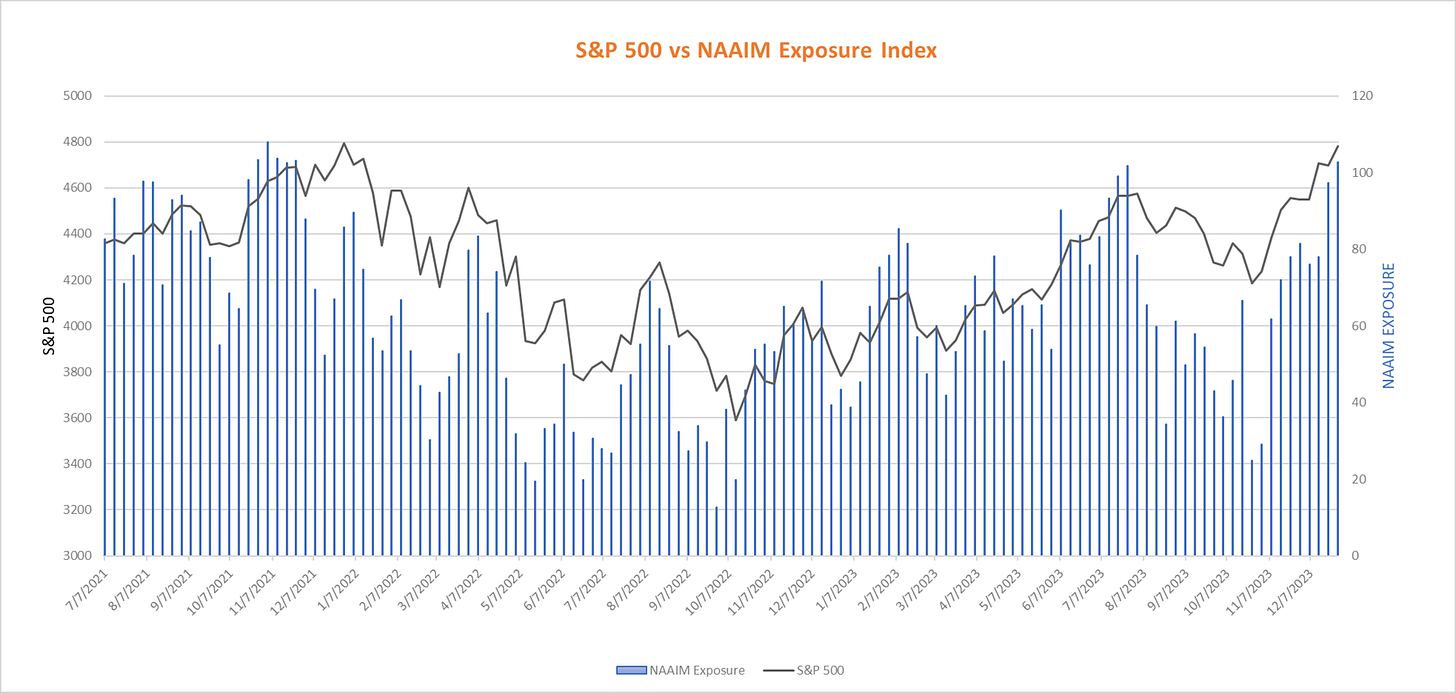

National Association of Active Investment Managers’ (NAAIM) positioning has done a round-trip from Nov 1st bottom:

NAAIM chart below is via Steve Sosnick at IBKR:

The index level jumped from 24.82 on October 25th to 102.71 on December 27th.

Indeed, the survey recipients’ aggregate positioning went from barely above neutral to leveraged long in just two months.

Is it any wonder that we saw the S&P 500 Index (SPX) rally sharply over that period?

Live Trading Room Summary

My December 3rd client post - Laggards – Unite and Ignite! - was well-timed.

Per Bespoke:

“the Russell 2,000's third biggest 2-month gain (+24.3%) in its history.”

It's time to start fresh after closing my Swing Long Portfolio of small cap outperformance last week (up 201% cumulative gain from last client update of 12.27).

We enter the New Trading Year with market extended, exhausted, hungover... whatever euphemisms you want to assess to current positioning, but technically we are just overbought not broken.

Yes, we are starting off with a bang - and not just the Earthquake in Japan with Tsunami warnings or the NASA energy surge from the sun that may cause GPS and satellites to go down for a spell. MAG7 and related growth/tech/semis are finally GETTING HIT on profit taking to start the New Year - as foretold by my Growth to Value indicator and usual tax deterrence tactics.

I contend, for now, this is a simple case of 2023 WINNERS undergoing profit taking - as oversold safety/value plays get bid strongly (XLU, XLP, XLV). The rotation we have been trading for two months is still on, just not in prior oversold losers/value/short-covering plays. Those are taking a break as safety/defensives make a move.

Intraday: Nasdaq volatility rose sharply - especially for AAPL, AMZN, GOOGL...but we need more breadth destruction and net selling under the surface to really trigger volatility.

Here's the best intraday cheat-sheet I've been using for clients past few weeks: VIX below 13.85 is market bounce worthy; above 14.49 is market trounce.

I still expect we get volatility of size, but it may not come until AFTER JAN OPEX with majority of leaps rolled/expiring off the board.

For now, Shake-N-Bake on weekly gap down in QQQ means opportunity for market weakness before a wee-bounce to fill the SPX gap at 4764 area, before really getting a taste of trend-reversal swing short opportunities post OpEx.

Much depends on dollar and yields. We've had that perfect bounce off 3.8% YEARLY SUPPORT, as warned last week. USD bounce in play as well. But big picture, yields may snake sideways off this 3.8% for months, and DXY has repeatedly hit $100 channel support 4 times over the past 12 months (not exceeding $107 channel high) and bounced, so we NEED a major macro trigger to break out of this sideways switchback.

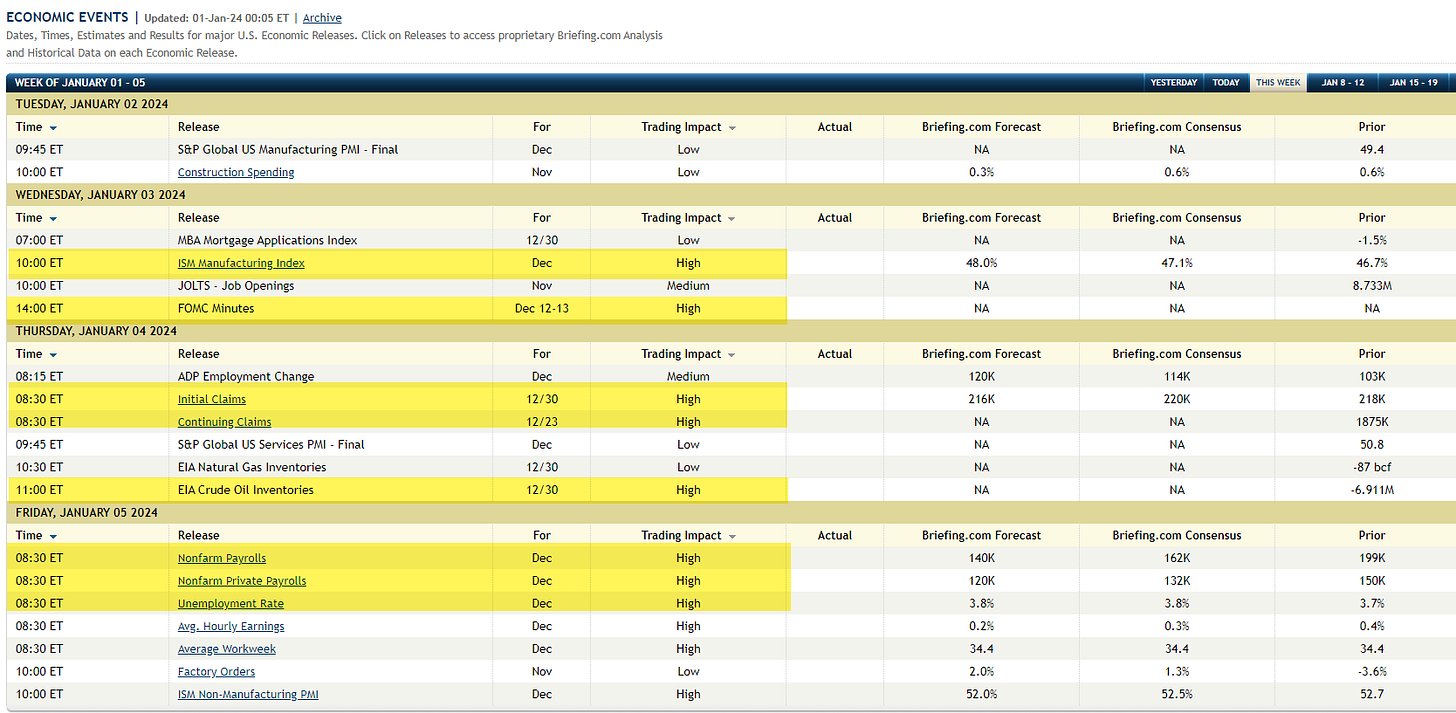

That's why it bears watching this week's macro event risk which will be focused mainly on FOMC minutes Wed, Jobless Claims Thursday and Payrolls Friday.

And of course, we will be live in my trading room and updating on new set-ups there.