Apple is Top Dog - In Stock Buybacks

CLUB/EDGE client post May 5th; Focus on "As Good As It Gets"

Thursday May 2nd, AAPL announced its biggest share back EVAH, at a time it is trying to camouflage weak fundamentals & Berkshire unloading shares..

Let's go back before we go forward:

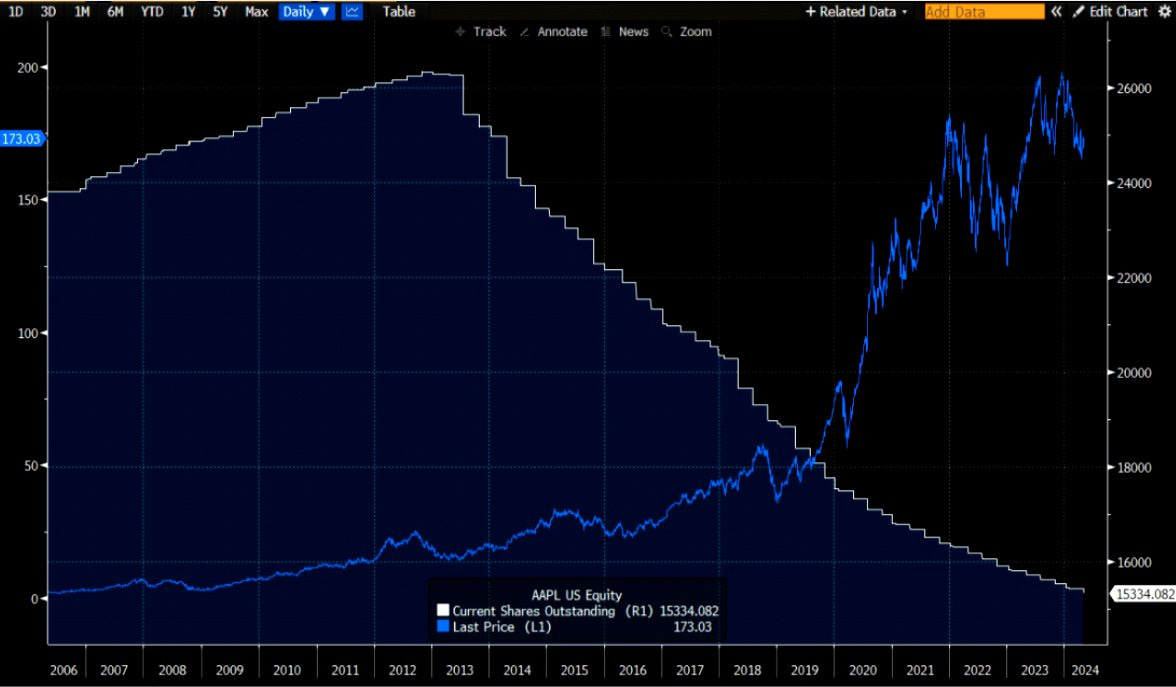

AAPL has shaved ~40% of shares from supply since 2013 - same year QE kicked in btw.

Then Thursday they did their BIGGEST Buyback evah - taking another 4% of shares outstanding out of circulation.

So why not invest in CAPEX or new products instead? Isn't AI important to forward earnings?

Also, why spend $110B when it is TWICE the $54B cash on hand and more than their annual income???

I get why it's a good idea to announce such a big buyback on the heels of disappointing fundamentals:

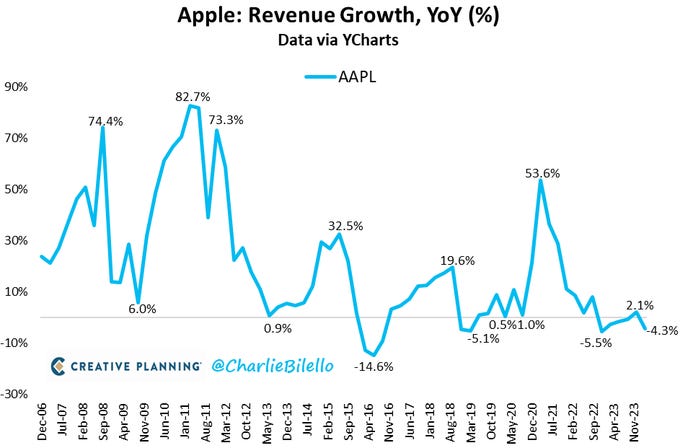

Apple revenues fell 4% last year - and they now have 5 out of 6 quarters of negative YoY growth with net income declining 2% YoY as well.

Fred Hickey @htsfhickey sums up well:

Apple revenues down 4% Y/Y. International revenues down 6%, iPhone sales -10% Y/Y (including inflation/prices hikes - wonder what units were - oh yeah, stopped reporting those),

Greater China revenues -8.1%, Japan revenues -13%, net income down 2.2% Y/Y.

But they slightly "beat" what everyone knew were "low-ball" estimates (but missed iPhone sales) and they guided to a $110 billion buyback (I'll take the under on that - just like last year).

And this crap report justifies a $13 (7.5%) jump in Apple's stock to a 29 P/E ratio?

I can't wait until this nonsense ends. In the meantime, I'll just keep buying more gold, silver & miners (whose earnings are growing rapidly).

No wonder AAPL kept their mouth shut and offered no guidance for Q3.

Didn't matter. Friday's stock gain added nearly $200B to Apple's market cap because of the large buyback - likely using cash overseas so they avoid paying US taxes.

And that's the point, isn't it?

Apple may not be raising CAPEX like others focused on AI, or crushing it with new product announcements, or growing revenues... BUT they have a high ROIC score that allows them to continue to return capital to shareholders in the most tax-efficient way possible by reducing net float.

Jobs was brilliant at innovative engineering.

Cook is brilliant at financial engineering.

But likely with diminishing returns moving forward, hence why on Saturday, at the Berkshire Hathaway annual meeting it was announced...

WARREN BUFFETT'S BERKSHIRE HATHAWAY CUTS APPLE INVESTMENT BY ABOUT 13%

That leaves about 49% concentration, so I'm not suggesting something is wrong to spur BRKB to sell. I'm suggesting AAPL earnings and buyback schemes qualify as a stock valuation that is "As Good As It Gets" for awhile.