And on the 9th Day She Rested

Yesterday, as the SPX and NDX traded in a tight ~20 point range, I laughed, "And they say don't short a dull market, ha!"

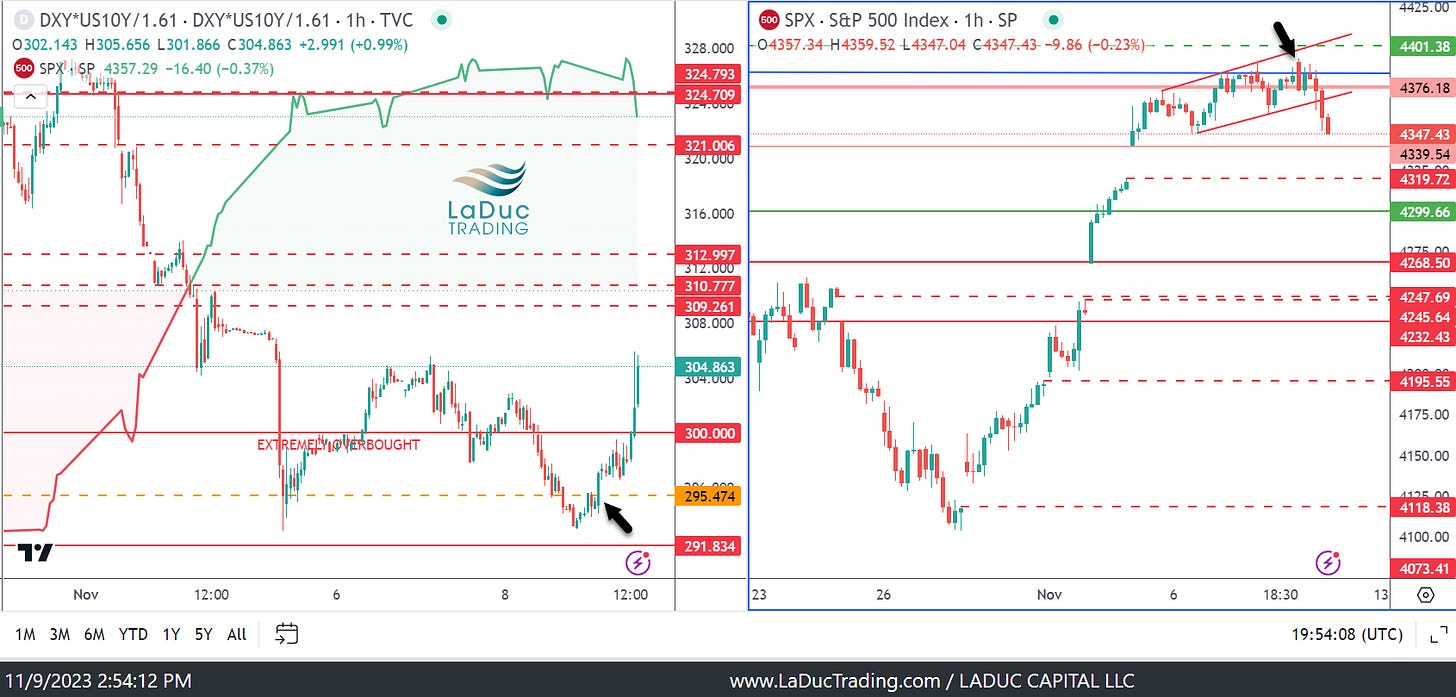

I also said, "Logic would dictate, market is exhausted". My baseline bet this morning in my live trading room was that we would not get above a key intraday level - as shown (black arrow) at blue trendline on the SPX chart (side-by-side with my USD/10Y ratio chart). We did a Pinocchio peak above for a New York minute, then dumped to form a perfect bearish engulfing bar on the hourly. It was the closest thing you get to a sure-thing short. (chart below).

Needless to say, I was high-conviction short focused, starting with TSLA near the open with a high-conviction trigger short of $215.82 on hrly into gap fill below near $206.

That was before VIX pushed back above my monthly $14.49 trigger with SVXY breakdown at $91. I mean, this was an easy lay-up short. Now the hard part. I recommended to clients this morning that a pullback to $4350 (major put wall) in SPX was baseline today, but I even doubled down and said we likely gap down tomorrow. So… I’m right by half (or is it clever by half)? Anyway, we will find out soon.

Other Highlights from the day...

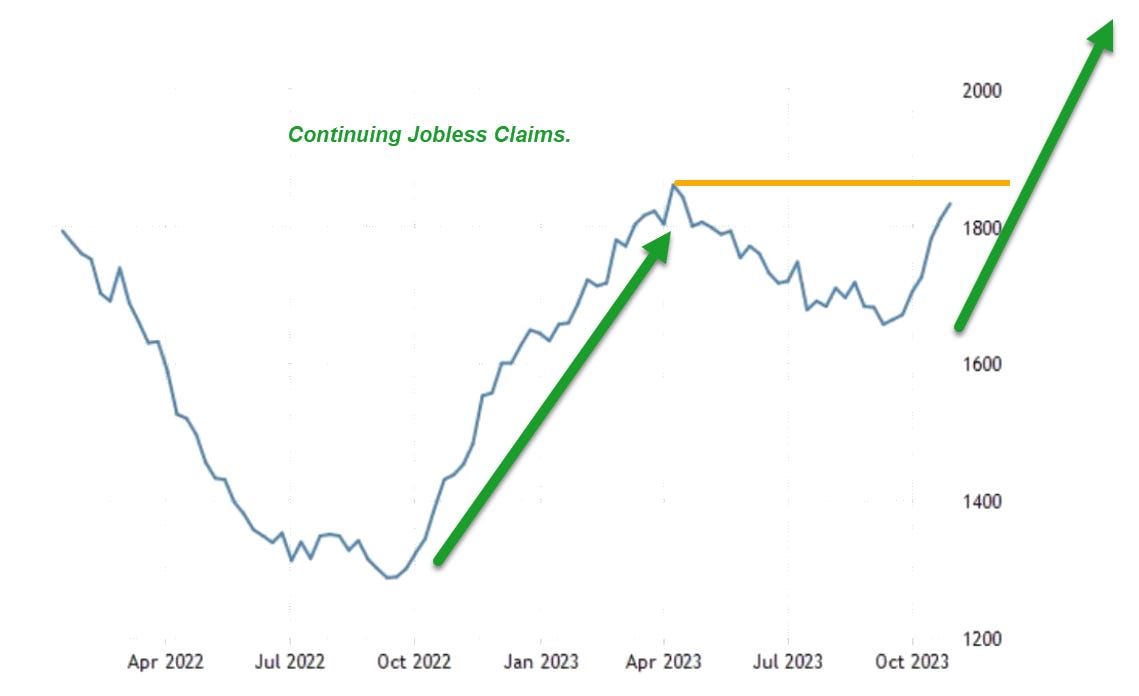

8:30 AM ET: Jobless claims continue to SLOWLY tick higher. See chart - doesn't that look like a nice bullish scoop pattern?

9:30 AM ET: We started the day in the green following the longest series of consecutive daily gains in 19 years! You know my mantra: "Outliers Revert With Velocity"

10:30 AM ET: Then gravity finally took hold and the live trading room was ready for it: TSLA dumped first then SVXY caved and SPX formed a bearish engulfing on the hourly and broke channel trendline down into my $4350 price target!

1:00 PM ET: 30Y treasury bond auction was abysmal as expected, forcing big banks to finance the difference! Rick Sentelli did a rant that sums it up well. And of course, Zerohedge jumped on the drama: "Stocks Tumble, Yield Surge After Catastrophic 30Y Auction Stops With Biggest Tail On Record As Foreign Demand Craters"

2:00 PM ET: Powell was hawkish.

And so it begins...Fed will get reactive on the way down (i.e. behind the curve on rate cuts).

So will inflation fall while Fed hesitates to cut, thus financial conditions continue to reduce growth and tip the economy into recession?

Or will inflation start to rise, Fed hesitates to hike, thus market prices in slowing growth and pulls forward recession risk?

Either way, FED IS TRAPPED as hiking will only stimulate recession risk and cutting undermines confidence they have slayed the beast that is entrenched inflation.

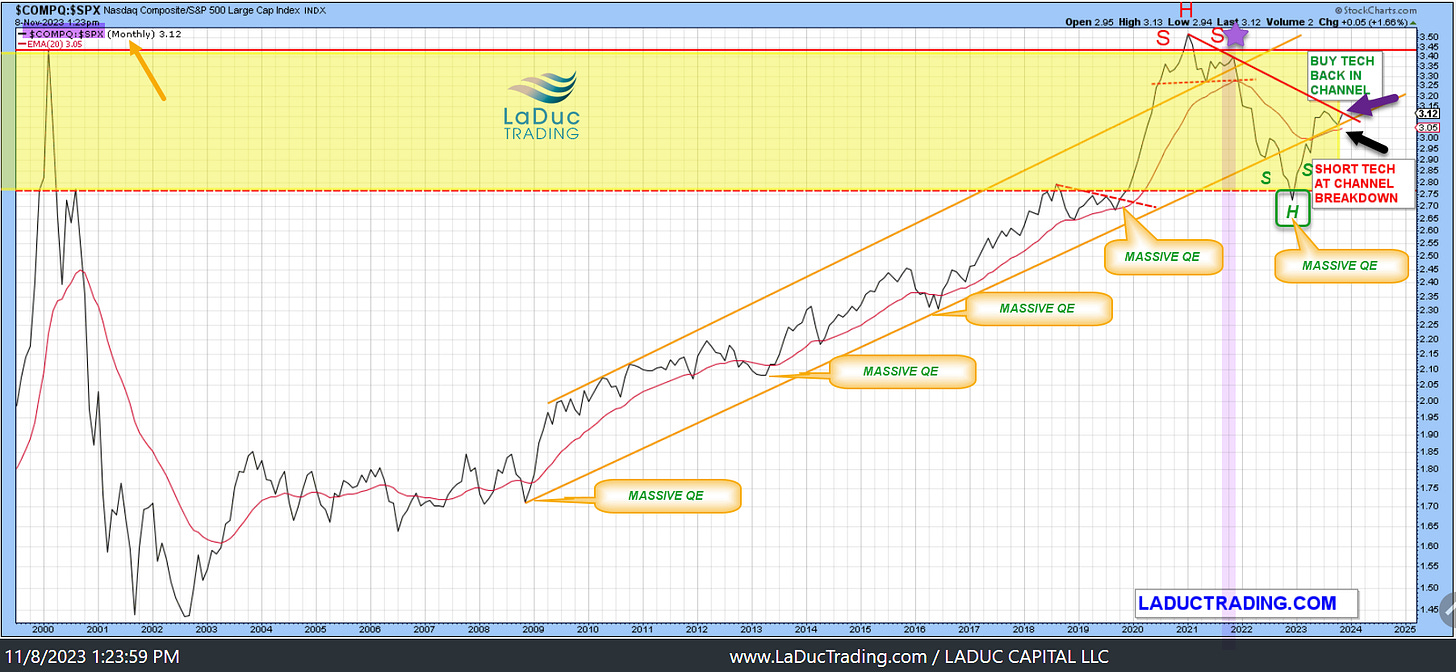

Santa Claus Rally Chances

Look very carefully at the last chart of COMPQ:SPX and how my warning OCT 26th of "BOUNCE HARD OR TROUNCE HARD" was answered with the biggest rally of the year last week. Now fast forward to yesterday, and we tagged the upper trendline before getting rejected firmly today. Lots of gaps below and above so it's early yet to rule out a pullback to $4250 that gets supported, BUT, if it does not, there will be less of chance of Santa and more for Scrooge

.

Another thought: Typically in an election year - so 2024 - markets advance strongly the 1st 5 months of the year as a sign of likely continued policies and re-election of a sitting POTUS.

My bet: we don't get that. I'm not sure what we get, or who we get, but other than a strong 1999 breakout above this key channel trendline, we are at bigger risk of selling off - at least until the next round of "Massive QE" backstops stocks and bonds.

Housekeeping!

Veterans Day is celebrated tomorrow, but markets are still open. So too will the trading room. By tomorrow, the Macro-to-Micro Power Hour Craig and I did today will be released, so look for that - Craig was once again able to field ANY macro-related question with ease!

Today, I was honored to be interviewed by Roger Hirst for a podcast to be released next week. Roger is a brilliant macro mind/educator whom I have followed for years from his days at Refinitiv and RealVision. I was really excited to be asked to be their featured presenter for November at Lykeion. I hope I did okay.

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!