A Most Profitable Trading Hack on DRAM Drama

By Luke Zhou of LaDucTrading

Luke here - your CHASE #Live-Huddle Trading Room Moderator, popping in for Samantha. We’ve been actively trading the sector rotation in Memory stocks over at LaDucTrading, and thought this might be of value to you here in Substack! Enjoy!!

The Hottest Sector Disguised as an I-Shares Country ETF

What if i told you I found a way to make a concentrated bet on the single HOTTEST sector in the entire market right now?

What if i told you NO ONE is paying attention to this yet, and this instrument has been available to us the entire time HIDING IN PLAIN SIGHT?!

What if I told you this ETF has a whopping 44% of its holding on just TWO stocks, and that those two stocks happen to be the single most in demand stocks in the entire market despite almost no US brokerages offering the ability to trade them?

And that these two stocks happen to combine for a whopping two-thirds market share of THE SINGLE HOTTEST SECTOR THAT IS THE SINGLE LARGEST BOTTLENECK OF THE AI TRADE?!

EWY Is All About The DRAM Play

DRAM is the hottest sector in semiconductors right now (early 2026) primarily due to explosive AI-driven demand outstripping limited supply, creating severe shortages and skyrocketing prices. The explosive growth in AI data center buildouts and GPU demand has created severe shortages, limiting the scale of AI training, inference, and overall deployment.

The key driver is High-Bandwidth Memory (HBM), a specialized type of DRAM essential for AI accelerators (e.g., Nvidia’s GPUs). HBM enables ultra-fast data transfer needed for training and running large AI models. Demand has surged as hyperscalers (Google, Microsoft, Amazon, Meta) build massive AI data centers.

Why It’s So Hot

Sold-out production — Major suppliers like SK Hynix, Micron, and Samsung have their entire HBM (and often broader DRAM) capacity booked through 2026, largely for Nvidia and other AI chipmakers.

Resource-intensive manufacturing — Producing 1GB of HBM consumes ~4x the wafer capacity of standard DRAM, meaning AI effectively eats up ~20% of global DRAM wafer supply in 2026 despite lower actual bit volume.

Supply constraints — DRAM bit supply growth is limited to ~16% YoY in 2026, while demand (especially AI/server) is projected at 30-35%+. Manufacturers prioritize high-margin HBM and server DDR5 over consumer/PC DRAM.

Price explosion — Contract prices rose dramatically in late 2025 and are forecasted to jump another 50-60% QoQ in Q1 2026. Year-over-year increases exceeded 170% in some periods, outpacing even gold.

This has created a “supercycle” with record profits for DRAM makers (e.g., SK Hynix overtaking Samsung in revenue), while rippling to higher costs for PCs, smartphones, and SSDs—potentially shrinking consumer markets by 5-9% in 2026.

In short, AI’s insatiable need for memory has turned DRAM from a cyclical commodity into a strategic bottleneck, fueling massive investor excitement and positioning it as the standout semiconductor segment for growth and profitability in 2026.

The DRAM Drama Queens

SK Hynix holds the leading position in the global DRAM market as of early 2026, having maintained the top spot for multiple quarters in 2025 with a revenue share of approximately 33-35% in Q3 2025 (per Counterpoint and TrendForce data), narrowly ahead of Samsung. The company’s dominance is propelled by its overwhelming leadership in high-bandwidth memory (HBM), capturing over 50-60% market share in recent periods, with HBM contributing significantly to its record profitability amid the AI-driven supercycle.

Samsung Electronics holds the second-largest position in the global DRAM market as of early 2026, with a revenue share of approximately 32-34% in recent 2025 quarters (e.g., 32.6% in Q3 per TrendForce and around 34% per Counterpoint), narrowly trailing leader SK Hynix. The company has shown resilience through strong conventional DRAM demand and a recovering presence in high-bandwidth memory (HBM), where its share rose to ~22-35% in late 2025 periods, positioning it for potential gains in the AI-driven segment entering 2026. It’s also a global leader in semiconductors, smartphones, displays, and consumer electronics, with massive investor interest due to its size (market cap exceeding $350 billion), innovation in AI and memory chips, and exposure to high-growth sectors.

Micron Technology holds the third-largest position in the global DRAM market as of early 2026, with a revenue share of approximately 25-26% in Q3 2025 (the most recent detailed data), trailing SK Hynix (around 33-35%) and Samsung (around 34%). The company has been rapidly gaining ground through strong growth in AI-driven segments like high-bandwidth memory (HBM), where its share has risen to around 20-21% in mid-2025 periods, positioning it as a key challenger in the high-margin AI memory space despite starting from a smaller base.

Get To Know EWY & KORU

EWY is the hottest sector disguised as an I-Shares Country ETF as is KORU its 3X equivalent.

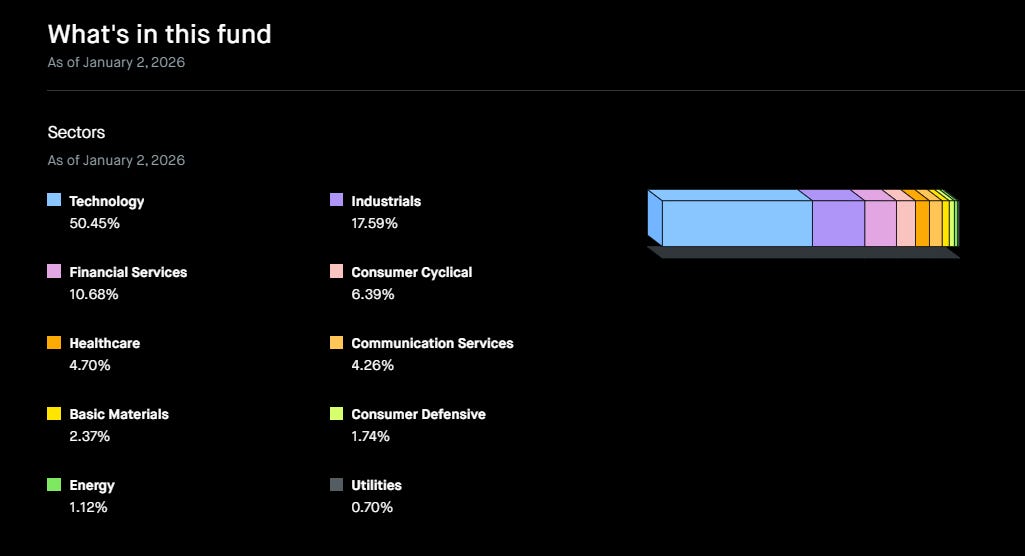

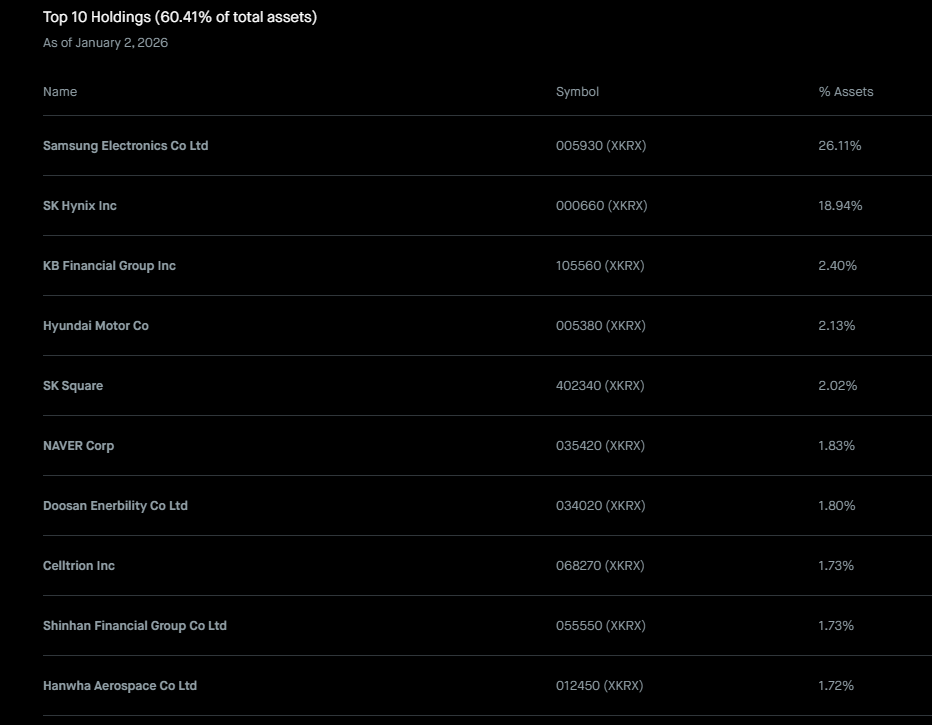

EWY tracks a market cap-weighted index of large- and mid-cap Korean firms - the listed name for EWY is iShares MSCI South Korea ETF.

THANKS TO THE ETF BEING MARKET CAP WEIGHTED, ALMOST HALF OF THIS ETF IS IN JUST TWO COMPANIES - SAMSUNG AND SK HYNIX - THE TWO BIGGEST PLAYERS IN THE DRAM MARKET WHO BASICALLY HAVE ESTABLISHED COMPLETE PRICING POWER!

And as an added bonus, this ETF owns Hyundai as the 5th largest holding (which owns 80% of Boston Dynamics which is arguably the single most established robotics player in the USA and is currently WOWing people at CES as we speak) and Hanwha, the shipmaker that basically has to build all of our ships for us because no US player can handle the task by themselves.

But let's stop pretending that what's in the rest of this even matters, because this fund could be 50% cash and just Samsung and Hynix and it would still be an ABSOLUTE CHEAT CODE!

And… KORU is for the torque as it is 3X levered EWY ETF Equivalent!!

What’s The Trade, Now?

We are in PROTECT mode over at LaDucTrading. Have a look at Samantha’s charts:

Here is EWY on a quarterly view. Quite the run-up, wouldn’t you say? Since the April bottom of last year, EWY has run up 123%. It is now hitting channel resistance… same day as SNDK, MU, WDC, STX put in solid reversal candles. We CHASE shorted them live.

At the same time, on the daily chart, EWY is putting in what is known as a evening star candle reversal pattern - at the same time 10X daily average volume in contracts hit the tape for APR $105 calls. The Huddle Team confirmed: they are selling not buying. We’ll likely see a reaction in Asia tonight/this weekend with some more profit taking in the DRAM Drama space.

KORU is also also an interesting look on the Monthly timeframe. Again, Samantha’s chart:

Just as the narrative of memory shortages hit a feverish tone, the chart of KORU has essentially gone parabolic - UP 802% since the April low.

But, it too is forming the same evening star candle reversal pattern on the daily chart, at the same time this 3X leveraged EWY ETF is 112% extended from its 200D EMA.

Samantha warns it’s a pullback waiting to happen to 217.60 then 190.91 with overshoot potential to 175.

As such, we aren’t suggesting members initiate new longs here but protect profits from this HOT FIRE FLAMES sector rotation - and/or help our members position chase/swing short at these levels. At least until the next wave of AI rotation bulls chase these DRAM Drama Queens again!

Summary:

DRAM is the AI chokepoint that everyone is talking about where the three main players have pricing power.

Of the big three, this ETF holds THE LARGEST TWO PLAYERS at a 44% concentration due to market cap weightings, effectively turning what should be a regular country index tracking ETF into a clandestine DRAM ETF.

There is a 3x Levered ETF version of this in KORU who prefer playing with fire.

You can use this for a main position, or to hedge any AI shorts, or to run pair trades with Micron - get CREATIVE!!!

Disclosure: no current position (already sold $KORU at $241.57)

Thanks for reading! And don’t forget to check out more amazing trading hacks & momentum trades in the LaDucTrading Slack workspace under #lukes-momentum-and-meme-stocks, in our Portfolio App in the membership dashboard and all day in our member Slack #live-huddle!!

The EWY construction is genuinely clever - hiding a concentrated DRAM play inside a country ETF wrapper. The market-cap weighting means 44% in just Samsung and SK Hynix, which is basically a backdoor into the HBM bottleneck without needing foreign brokerage access. I've been tracking the capacity constraints you mentioned and the math checks out: when HBM consumes 4x the wafer space per GB versus standard DRAM, that 16% supply growth vs 30%+ demand is going to keep pricing power firmly with these duopolists. The reversal signals on WDC/SNDK make sense given the run, but the structural thesis around memory shortages hasn't changed. Timing protection around overbought levels whiel keeping exposure to the secular trend seems like the right move here.