Trend Long Uranium Sector: WORKING!

I was bearish into Friday even before news of Trump threatening 25% tariffs on Apple and retaliating against EU for their trade deal proposal with tariff rate of 50% effective in one week, June 1st. Obviously, we gapped down on that news pre-market, so the directional puts into end of week really worked, but I would expect more selling at some point next week given falling liquidity.

Short Updates:

Tues was when I warned selling under the surface had started & followed lower every day since.

It also timed with ES fading back inside 5925 support.

I can still see a case for ES to reach 5687 with overshoot to 5600 as that gap fill on the futures is a magnet.

I can still see lower for QQQ + SPY as well - whether from selling ahead of NVDA earnings or soon after, or from some macro event risk over the weekend/next week. Hopefully not Israel following through on its threat to attack Iran's nuclear facilities this weekend.

VXN still has measured move to 28.32 so it may have retreated back to daily support at 25.15, but it didn't close below which is bearish NDX.

Commodities:

Gold continued higher into trendline just above 3357.21 which I also expected as stocks weakened.

Copper via COPX +/or FCX continued higher into weekly trendline.

XME is also pushing higher into its weekly trendline as a result.

Uranium WOW

Here's a detailed write up on why I am Trend Long this sector.

The whole sector exploded today on news Trump would sign an EO to support the industry:

U.S. President Donald Trump will sign executive orders as soon as Friday that aim to jumpstart the nuclear energy industry by easing the regulatory process on approvals for new reactors and strengthening fuel supply chains, four sources familiar said, Reuters reported. Facing the first rise in power demand in two decades from the boom in artificial intelligence, Trump declared an energy emergency on his first day in office.

I did a whole review live Friday morning of the key Uranium stocks: CCJ, UEC, UUUU, GEV, VST, CEG, SMR, OKLO, NRG, TLN, BWXT, LTBR & ASPI also FLR.

Reminder, I have CCJ, URNM as trend longs since Nov 2020, as well as FLR, BWXT (with PWR).

OKLO was rec'd swing long.

Of all the above, I think FLR is best value after selling off to its 400W at $36

FX Updates:

I rec'd short USD/CAD (1.47 now 1.37) AND the USD/MXN same time (20.7 now 19.2) and both still looks good for lower this year.

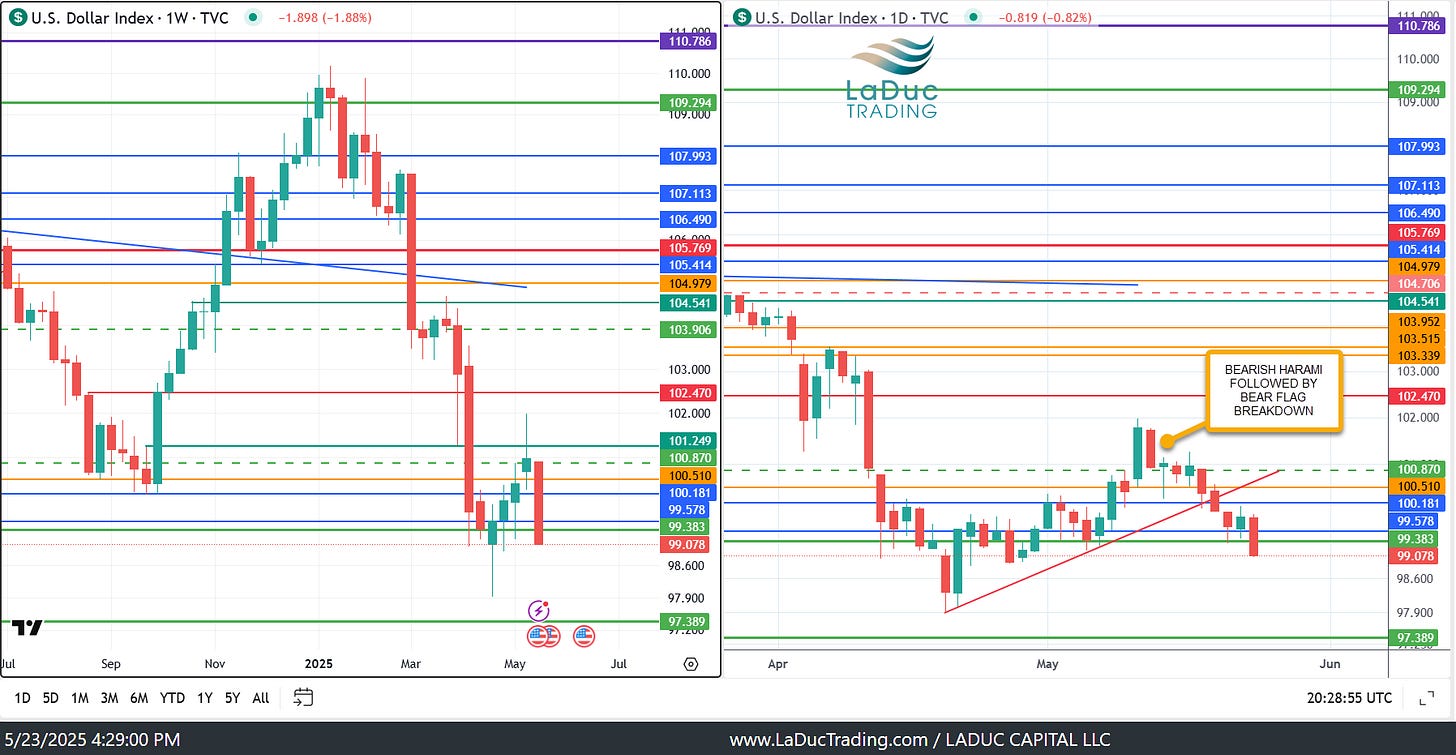

USDJPY broke bear flag on Tues same time as USD broke its bear flag. Both fell rest of week which was bearish equities.

Stock Updates:

PTON continued higher an entire dollar since call out Wed with Jul $7C doubling and 97K contracts still haven't closed.

DB rec'd short since Wed working well.

XLF rec'd short since Tues working well.

TJX rec'd short since Tues overshot my 128 PT to tag 125.70.

SMH, NVDA rec'd short since Tues working but neither NVDA nor TSM has tagged their 200D PT, yet.

OK, that should do it!

I wish you all a fabulous rest of your weekend!!

in tc2000 for the 400 week indicator are you using ema, sma or some other setting?