JUMP-RISK IN BOTH DIRECTIONS

Semi softness was a driving reason for the early weakness in markets today, as I pointed out in my live trading room pre-market.

Specifically I highlighted the news that Goldman Sachs significantly lowered the global Al server shipment forecast... which would be reason enough for shorts to press SMH, NVDA, AVGO lower.

But it wasn't the only reason markets gave sway. The Congressional Budget Office came out with a stark reminder that the debt ceiling would be hit prior to August if ...

If the government's borrowing needs are significantly greater than CBO projects, the Treasury's resources could be exhausted in late May or sometime in June, before tax payments due in mid-June are received or before additional extraordinary measures become available on June 30.

And maybe ** they ** knew that Trump would be imposing permanent tariffs on auto imports at 25% after market closed!!

This is not the kind of headline investors are use to seeing:

TOYOTA SHARES UNTRADED AMID GLUT OF SELL ORDERS

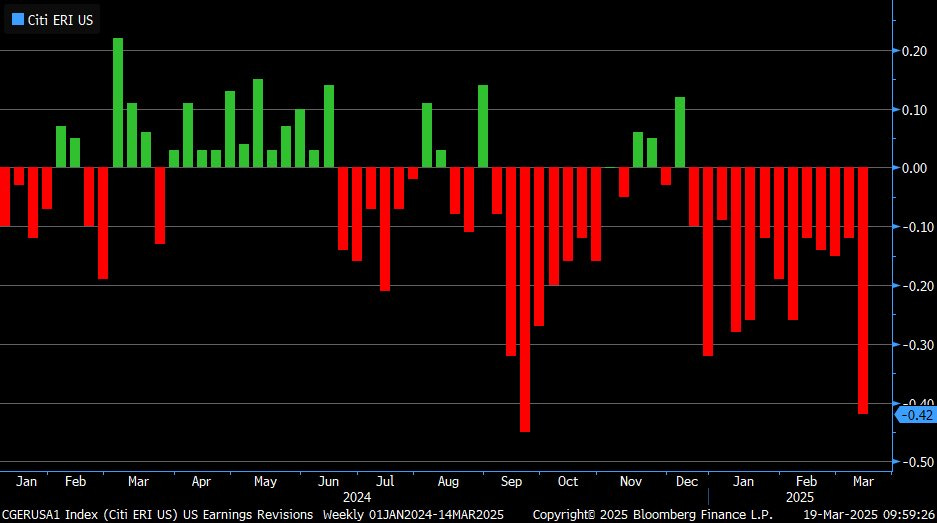

All of this before April 2nd Reciprocal Tariffs are threatened to be made permanent and before non-farm payrolls on Friday and before earnings season kicks off after U.S. Earnings Revisions Index has been negative for 13 consecutive weeks.

Also, the NEW tariff hits keep coming...

Trump is also threatening secondary tariffs of 25% on anyone that buys oil from Venezuela? Yeah, that's meant for China in particular; Asia in general.

But point it, there are a lot of mercurial market moves that are not only shaking but wearing US investors out!

Is it any wonder, US continues to underperform as MONEY GOES HOME -

MECURIAL MARKET MOVES

Friday:

"market would be hard-pressed to get/close above 5670 monthly resistance. Once it does, we see 5783 in a hurry, but we need a macro trigger - like Trump saying on the eve of reciprocal tariffs April 2nd: “I was just kidding.”

Monday:

"we got this Sunday so market is ramping on tariff delays for autos & chips.

we are headed to 5783 after 5767 monthly resistance - so think overshoot to 5783 then we likely fall back to/below 5767 and revisit 5705 THIS WEEK."

Monday saw jump risk of 100pts up on tariff-talk walk-back so that my SPX 5783 PT could tag Tuesday.

Then this morning/Wednesday we got rejected exactly at 5783 intraday, but the real test I said would be to break below the convergence of moving averages for SPX (200D, 21D +3D) which price was sitting on at the time (5756). I said if we do push below, it will be a fast break back to the 8D to form an evening star reversal. That's exactly what happened - TO SO MANY STOCKS. And now, this daily candle reversal pattern sets us up for a daily gap-fill back to 5670.84 this week.

QQQ dropped strongly & closed below its 8D with daily gap fill from Friday at 481.76. We tagged it after hours.

Luckily, I warned TUES that VVIX was setting up for a bounce (81.73 wkly bollinger band tag) & called out that not only did VVIX close +7% Tues but VIX would likely bounce off its 200D at 17.04. Both had a solid day today.