First, Some Macro

In keeping with my theme: MONEY GOES HOME…

Here we can see the biggest drop in U.S. Fund Manager equity allocation on record (for March) - via BofA - which accompanies the 2nd biggest drop in global growth expectations... which accompanies the highest allocation to Euro Zone stocks since July 2021.

S&P 500 ABOVE 6,000 POINTS IN Q2 REQUIRES REVERSAL IN INFLATION/TRADE WAR CONCERNS; RECESSION WOULD DRIVE INDEX BELOW 5000

As a result, overestimated 2025 GDP estimates are getting revised lower. The bar was low in both 2023 & 2023 - not anymore.

It may be hard not to price in -GDP print this year from April 2nd tariffs given...

“Goods imports make up 11% of US GDP, and 43% of US imports come from Canada, Mexico, and China. This means that 5% of US GDP is directly impacted by higher tariffs on Canada, Mexico, and China. This is meaningful when annual GDP growth normally is 2%.” Tosten Slok

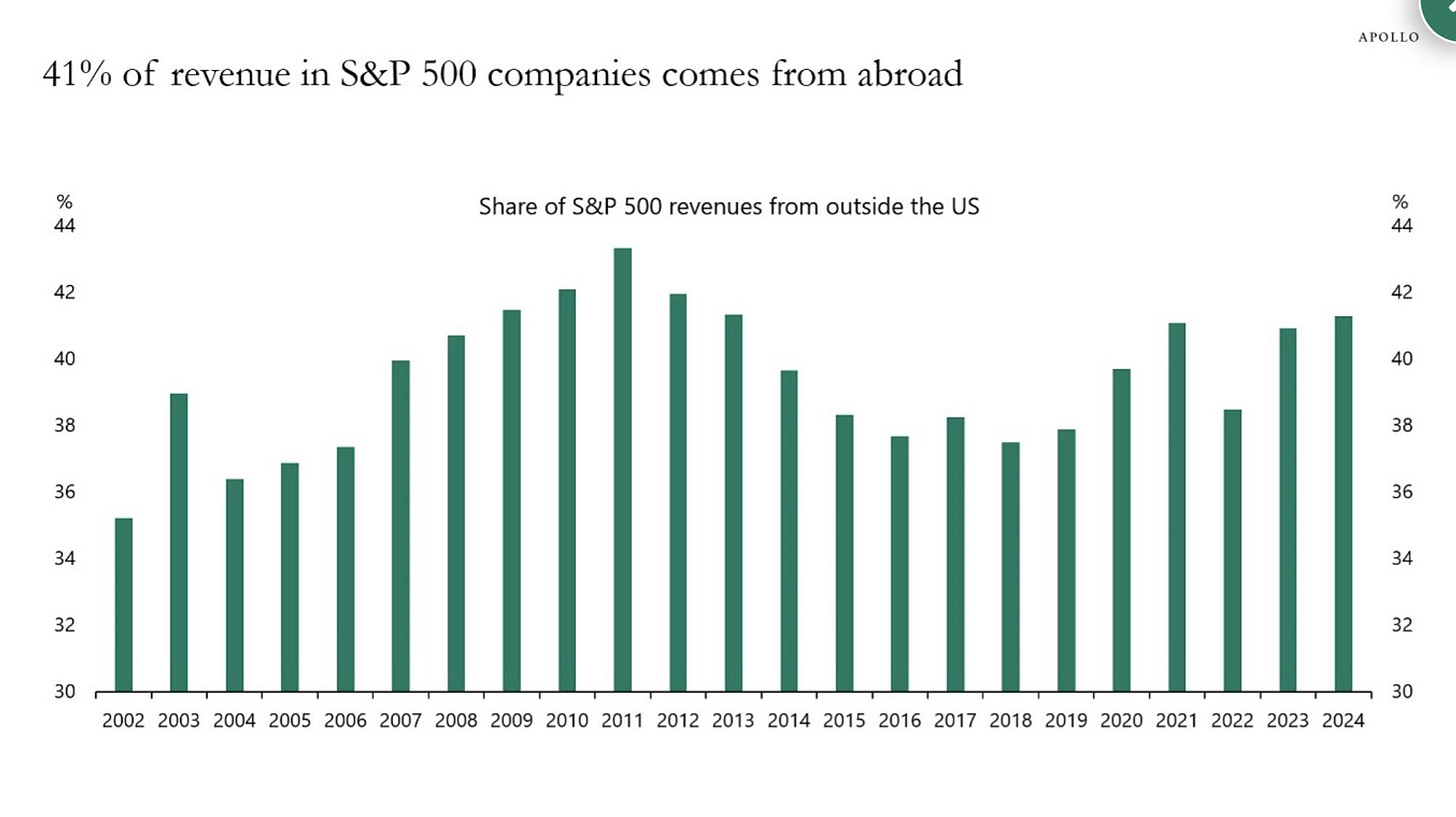

And given 41% of revenue in the S&P 500 companies comes from abroad, tariffs and trade wars will require earnings estimates to be re-rated.

But so far, we have barely a re-rating! After a -10% pullback for SPY, its earnings yield is 4.79% - with a high in May ’24 at 4.9%.

Why does that matter?

2025 EPS estimated growth rates are still bullish! +7%, +10%, +12.6% and +11% for each quarter of 2025. H/t @TrinityAssetMan