A Green St. Patty’s Day

GREEN SHOOTS OF STABILIZATION - as posted Friday morning - just in time for St. Patty’s Day!!

As discussed this morning live, VVIX dropping much more than VIX is bullish market! VIX also falling back to ~21 wouldn't surprise.

…In the same way I said that some funds go to CASH when we enter VIX Backwardation, they re-enter when it ends.

Hans weighs in on bounce potential from market structure view:

"Fixed strike vols really relaxing, which is a good sign - that means the out of the money puts have been compressing in pricing, which is a sign of folks selling out their hedges and not panicking (especially MMs). If the MMs were truly offside and ready to jump off a cliff you wouldn't be seeing this action. And when OTM puts compress that reduces short Gamma. positive short term."

Oh, and last but not least, as I posted Thursday in #trading-room-notes:

"SPX - today filled my “5523.64 PT” so now it is allowed to bounce ;-)"

Hans nailed it last Wed in our Macro-to-Micro OPTIONS Power Hour:

"I feel there is potential for a good 150-200 point move up."

JOIN US THIS WEDNESDAY POST FOMC DECISION!

The Week Ahead

Before we look ahead, let’s briefly review the weak Februrary retail sales this morning which show a continued fall in discretionary spending MoM but are still positive at the core:

+.2% vs +.6% expectations is a large miss with January revised down to -1.2% from -.9% while Empire Manufacturing came in at -20 vs -2 expectations, so… more contraction.

The Atlanta Fed’s GDPNow model now estimates Q1 lower…

GDP at -2.1%, down from -1.6% just 10 days ago. A big drop in personal consumption growth (from 1.1% to 0.4%) following weak retail sales is driving the decline. With the FOMC blackout in effect, further updates—including trade adjustments—will come after March 26.

The OECD lowered its 2025 U.S. GDP forecast to 2.2% from 2.4%, while JPMorgan cut its outlook to 1.6% from 1.9%, both citing trade barriers and policy uncertainty.

Ironically, as retail sales missed, retailers jumped - mostly from hedge fund factor rotation (read: short covering) is my bet. And as NY FED orders slumped amid a surge in prices paid, small caps rallied - again, more from mechanical flows than fundamental ones.

Next up we have Central Bank meetings with FOMC of most importance, but also BOJ, BOE and SNB. Only SNB is expected to cut.

Fund Flows & Seasonality

Markets fell from Feb 19th into March 13th with S&P falling -10% and Nasdaq -15%. With two weeks to go…

JPM estimates that the potential equity buying from month-end rebalancing by balanced mutual funds, as well as quarter-end rebalancing by US defined benefit pension funds and Norges Bank/GPIF/SNB, is around $135bn.

This often times rhymes with Nasdaq 100 seasonality:

So the question you need to ask yourself is whether you think 2025 is more like 2022 - where oversold stayed oversold UNTIL policy intervention (like Sept/Oct 2022), and where folks dumped equities versus hedged…

OR is it 2023/2024 where oversold led to violent bounces in convexity short-covering rallies on VIX hedges being unwound, on expectations of policy intervention to tap down dollar, yields and VIX, and where economic expansion and strong business/consumer activity supported the bullish flows?

Policy Agenda & Recession Risk

It seems likely the Trump Administration is orchestrating a policy agenda to weaken corporate and consumer confidence, that will reduce demand and growth, not to mention demand for USD, which will help to deflate inflation risks from rising US yields and oil, pulling forward recession risk.

Why do I think that? Among other things, Treasury Secretary Bessent keeps telling us that:

“Corrections are healthy. They’re normal. What’s not healthy is straight up, that you get these euphoric markets. That’s how you get a financial crisis.”

Bessent added there are “no guarantees” a recession would be avoided during the economic “detox” period.

I know the stat: outside of recessions, buying a -10% SPY dip has been a good equity-long bet. But with recession calls growing louder, a short-the-rip mentality is growing.

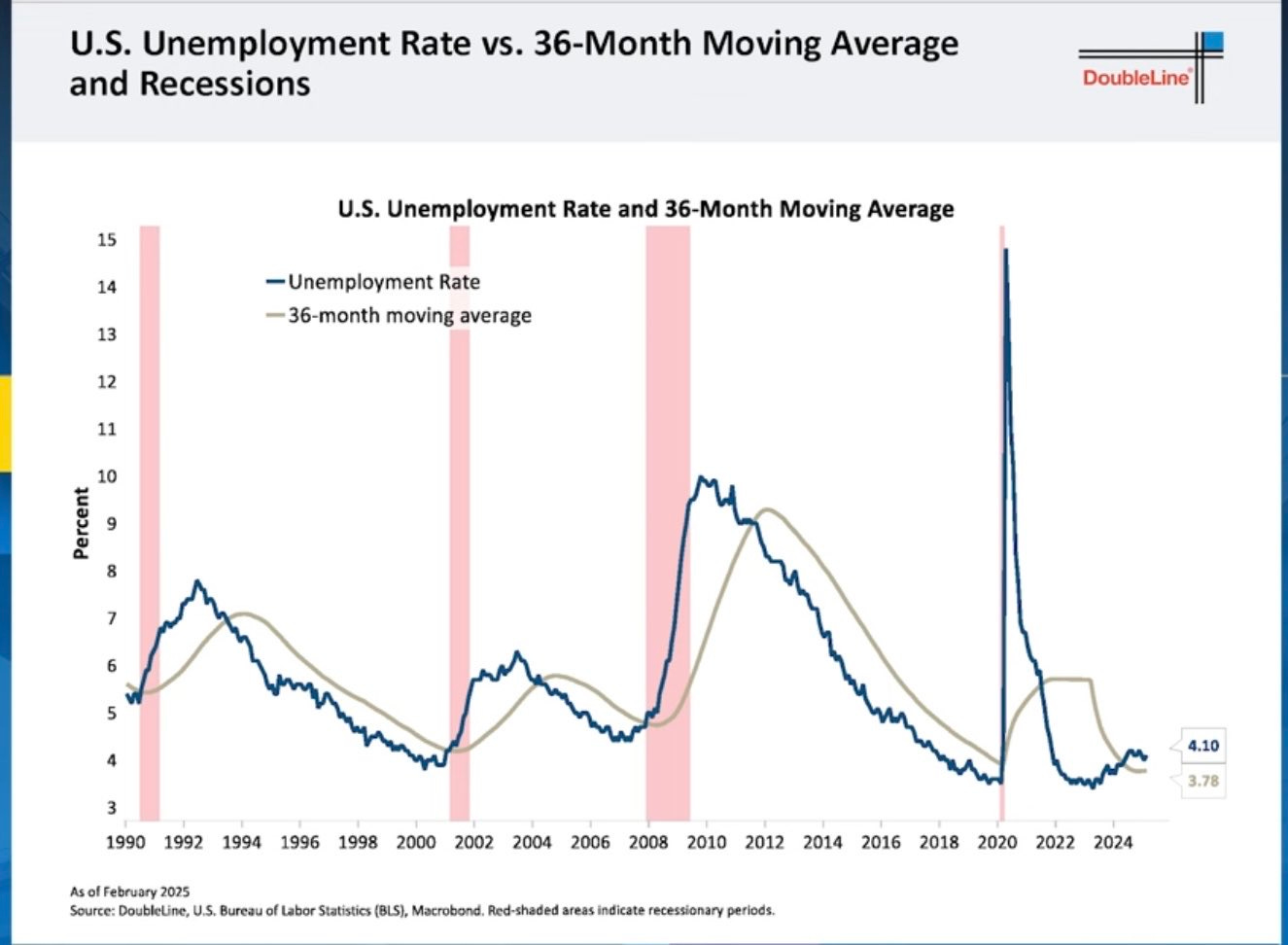

Gundlach was out last week giving recession 60% odds. Here are his most bearish charts: