Checklist Engaged

From Tuesday:

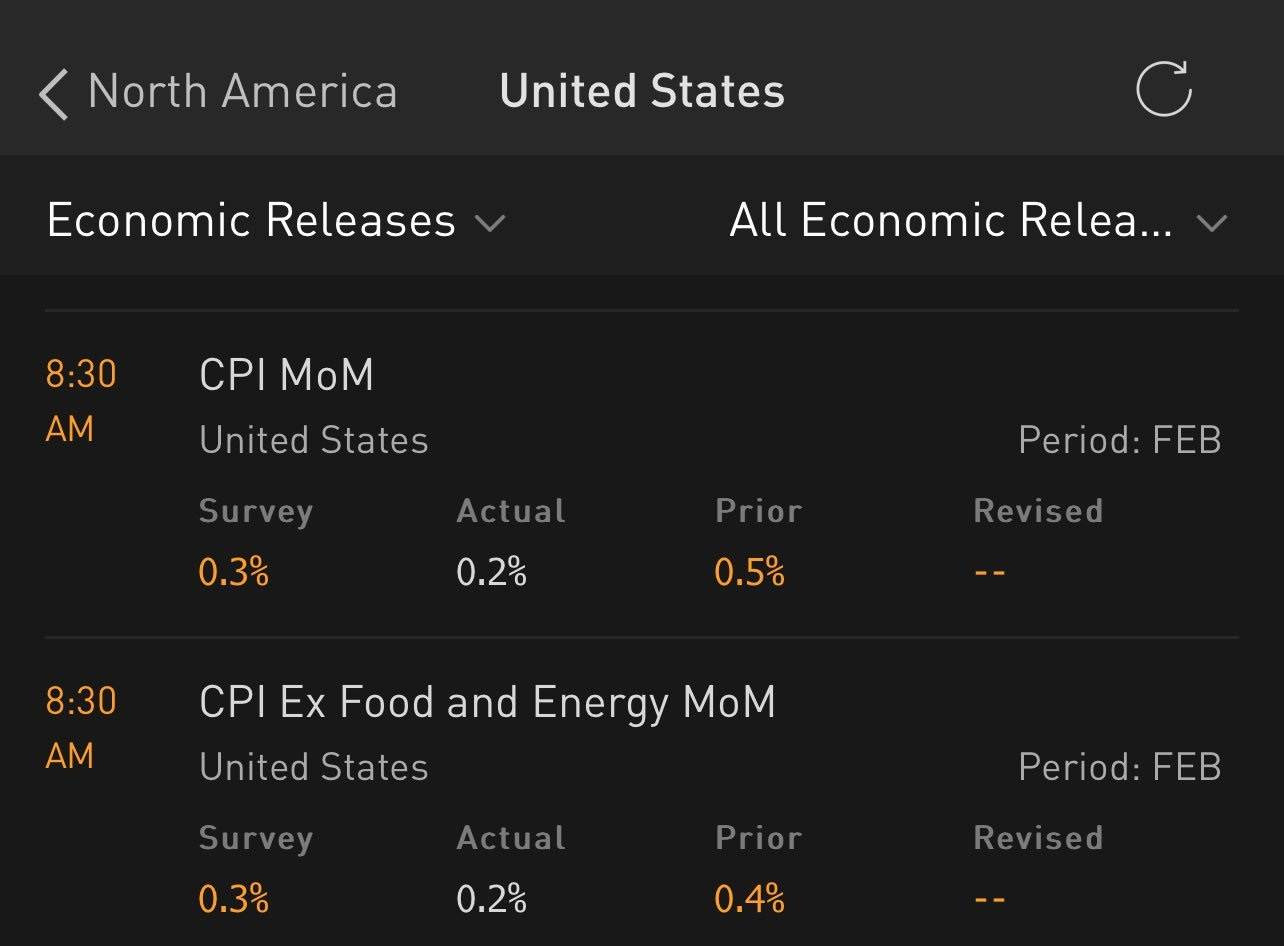

Yup, CPI was cold!

“February CPI at +2.8%, below expectations. Woop! Core at 3.1% lowest since April ‘21. Why? Services have been keeping the flame HOT & but now starting to drop. Transportation deflation -0.8% m/m. Start of the DOGE effect!? Bye bye govmt biz class trips!? Plus, gas down a lot…” Wasteland Capital @ecommerceshares

As Geoffrey tartly states,

“if you fire a lot people at the Gov (meaning reduce gov spending) and if there is little change in output as a result, inflation fades quickly.”

Speaking of Geoffrey, long after he recommends China, we now have Citibank and JP Morgan recommending China! JPM is even more tactical, reflecting what I see a lot of on FinTwit: colleagues expecting a sizeable bounce - to short into ;-)

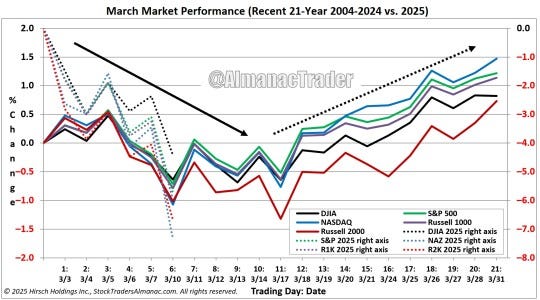

Seasonality also favors Ides Of March:

Stormy March markets have battered stocks lower in the first half of the month in recent years. Named after Mars, the Roman god of war, the third month of the year often serves as a battleground for bulls and bears. Julius Caesar may not have heeded the famous warning to “beware the Ides of March,” but perhaps the bears should take heed this year, at least for a bounce.

Several key technical levels have been breached which unfortunately brings support around the September lows and last March’s highs in the 5300-5400 area into play. But a near term bounce is setting up for later this week or early next, though it will need some sort of catalyst from President Trump, the Fed, Congress, rates, inflation or geopolitics to trigger it. via Jeff Hirsch @AlmanacTrader

Big Shorts Still Engaged

My Top Ten version anyway ;-) DAL UAL JETS ARM CVNA ANF IRM INTU NVO FDX