2/26/25 Live Trading Room Market Recap & Trades

With focus on a coming bounce then trounce.

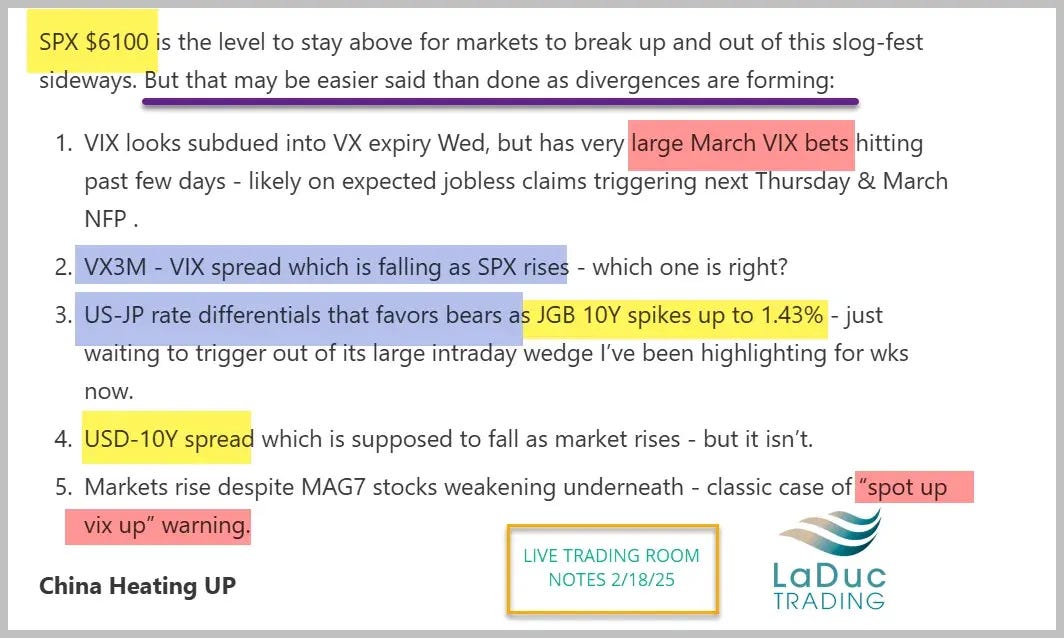

The Easy Money Was Made

Timing the top of this recent pullback last Wed was helped tremendously by the fact I scan & synthesize across silos of data: MACRO, INTERMARKET, TECHNICAL, FUNDAMENTAL, SENTIMENT & QUANT. And from these disciplines, my analysis on the divergences forming from my intermarket-macro ratios helped me with my conviction. Also, the technical patterns I could envision forming (after many, many hours of spying similar set ups). I shared these each morning in my live trading room & selectively in my #trading-room-notes so as not to overwhelm. I know it was a lot for you to hear last Thursday:

I see “oil & yields dump, yen & bonds spike, pushing equities lower & triggering (perhaps outsized) volatility.”

In fact, the day before (Wednesday) at market highs ($540.81 QQQ), I rec’d to short under $539 based on the bearish divergences I spied Tuesday:

Now that NDX has pulled back -6% and NVDA earnings are out of the way, it is time to prepare for end of week/month.

Given that MANY of the short rec’d plays have fallen into TECHNICAL BOUNCE AREAS - or nearly, like TSLA approaching its 200D - it’s time to be on the lookout for my QQQ PT of $506 with overshoot to $503 as potential stabilization level for monetizing outsized puts before a potential bounce.