2026 PREDICTION: ROTATION & RECESSION INTO ALL TIME HIGHS - PART 1

Consumer Cyclical Rotation Got Popular

About That Yield Curve Steepener

My Top 2026 Trading Themes Remain My Focus

Consumer Cyclical Rotation Got Popular

Nov 26 client post: Sell The Rumor of Consumer Cyclical Slowdown; Buy The News.

This early theme has resulted in some great chases in oversold retail & software names like DLTR, DG, ADBE, CRM, LULU... etc

Just so happens all of Wall Street is a flutter as Consumer Cyclicals are killing it this week!!

But they are getting it wrong on why:

No, it is not because the economy is reaccelerating. There is no data that suggests economy is expanding outside of the speculative Capex mania & money bubble of fiscal/monetary largess. The real economy is contracting with St. Louis Fed Real GDP printing a barely positive .42% today.

This rotation is pure and simple: MONEY ROTATION out of AI STORY STOCKS into defensives/low beta from high beta/growth.

It’s SAFETY not confidence.

No, it is not my bet the rotation will follow the old axiom where “true safety rotation goes to utilities/staples”.

True safety rotation is out of the MOST unsafe and into the MOST safe.

Just so happens, Utilities are loaded (50% cap weighting) with DATA CENTER AI ecosystem plays.

And lots of Staples deserve to be left-for-dead.

This rotation is about QUALITY value.

No, consumer cyclicals and small-caps breaking out to fresh ATHs are not screaming reflation.

Prices are up 30% post Covid - firms monetized through margin expansion: Price over Volume. Now, margins should contract as consumer spending slows from already-priced in inflation.

Again, rotation into small-cap growth & large-cap value is all about SOURCE OF FUNDS. They rotated into Growth for 2023-2025 & now they are going to rotate out. And into low-beta, oversold, high-quality Value.

If you’ve followed me awhile you know my mantra:

IN LIEU OF SECTOR ROTATION, THERE WILL BE VOLATILITY.

The lazy bull AI trade is ovah! I warned about this early October - SENTIMENT HAS TURNED!

I positioned clients in November for factor rotation: oversold sectors & stocks for a reason!

Actually two reasons: MOTIVATIONS & MONEY FLOW ;-)

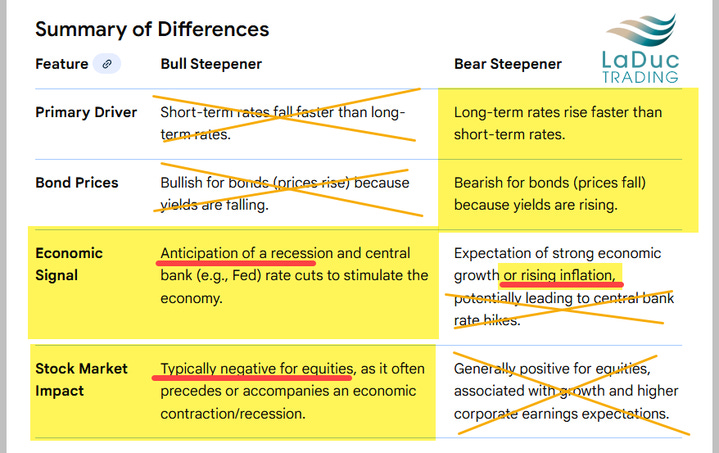

About That Yield Curve Steepener

From my December 2024 Predictions (read: last year not this one), I predicted that the 10Y2Y yield curve would STEEPEN from barely positive to 90bp by end of 2025. Obviously mid year I needed to push that prediction out to 2026 as we had many, many policy interventions of rate suppression, but the target remains the same.

The point of this prediction was to warn that long-end bonds were NOT safe until this level was reached. Since then - and just in the past two months - Paul Tudor Jones, Gundlach & many of the greats have said the same: 100bp. Gundlach went bigger: he said he wouldn’t touch the long-end bond until the 10Y yield was 6%!

When I asked Geoffrey if there was any reason he would be a buyer of bonds. He summed up thusly:

“I would not hold the 30 yrs under waterboarding.”

OK, so that’s consensus of sorts. But what will not be is WHY the yield curve is steepening:

Strong economic growth or rising inflation?

I say more the latter and less of the former.

Positive for equities & earnings?

I say more likely economy contracts from rising unemployment, falling disposable income and recession risk pulled forward.

I guess you could say that I learn about the reasons for rotations or steepeners and then I check them against the model I use: Mom Smell Test.

As such, here are the risks the steepener may create:

Above .65bp it can pick up speed. I said it all year: It’s not the level of flatness, but the rate of change when the steepener takes flight. Remember April? When the 10Y flew from 3.9-4.5% in 4.5 days? Well, my 10Y2Y steepened to my LINE-IN-SAND .64bp before Trump/Bessent intervened. I still contend, we will have .90-100bp before 10Y bonds are bid.

Because the steepener will be interpreted as bullish growth, in the same way consumer cyclicals will be interpreted as bullish growth, the move higher will trap the bulls.

Also true: I can still see SPX $8200 in a melt up. Same levels I gave in June. I said if we could “get/stay above SPX $6100, we would move into $7000. If we can get/stay above $7000, we can move into $8200.”

All the while, I will refer to this bull trap as my continued theme of RECESSION INTO ALL TIME HIGHS.

The real US economy is not participating in this equity advance as US dollar debasement bids inflationary assets.

It bears watching the AI bubble dissipating, as fiscal/monetary largess pumps inflation not jobs.

Also my theme of US GOVT AS VENTURE CAPITALIST is financing a lot of “national security” projects, but by definition that is inflationary.

We can have falling rent costs come into view 2H of 2026, but the continued flow of funds into COMMODITIES and CAPEX makes it hard for inflation to deflate meaningfully. Or for the Fed to cut meaningfully, for that matter - for other than political expediency.

My Top 2026 Trading Themes Remain My Focus

Industrial Commodities - not oil

Value - high quality (”oversold, not as bad as feared”)

AI/Space - those that can prove monetization

US Govt as Venture Capitalist - bumpy but supported

USD Debasement - and steeper 10Y2Y yield curve

Despite these sector opportunities, there are still macro risks with no schedule of release that bears watching:

Rising 10Y yields, REPO

Spiking Unemployment, Inflation

Unwind in NDX Concentration Risk, Yen Carry Trades

Falling Dollar, Oil

Nvidia Fraud, Cold-Turned-Hot War

Last year in December I was quite bearish at $6000 and gave $4800 as major support in a drawdown with $SPX 6666 likely year end target. That worked great - so far!

This coming year I see much more sideways distribution in 1H between $7000 and 6500 - with major support at $6147 should big drama unfold - and major upside resistance parabola trap at $8200 should a big melt-up ensue 2H on falling dollar.

Ultimately, I keep one eye open for macro event risks while tactically trend long, but my warning since September for sideways distribution will give way to rolling waves of volatility next year as rotation and recession take center stage.

Next Up:

2026 NON-CONSENSUS MACRO VIEWS - THEN AND NOW - PART 2

2026: $8200 SPX, MALINVESTMENTS, AND MISPRICED EXPECTATIONS - THE WHAT IFS - PART 3