2026 NON-CONSENSUS MACRO VIEWS - THEN AND NOW - PART 2

2026 IS PRICED FOR PERFECTION

In follow up to…

2026 NON-CONSENSUS MACRO VIEWS - THEN AND NOW - PART 2

“THINGS OVER PAPER” -

"BONDS ARE DONE GOING UP" -

“FALLING GLOBAL OIL DEMAND” -

“MONEY GOES HOME” -

“RECESSION INTO ALL TIME HIGHS” -

2026 IS PRICED FOR PERFECTION

Underappreciated risks are those that can occur but are not priced in as they represent probabilities that are hard to quantify so most ignore.

In an era of EASY MONEY, being risk-averse has been harmful to bears, BUT... lawyering the trade between bullish & bearish has always helped me be risk-aware so that I can better identify asymmetries, blind spots the market does not see yet, and most of all, opportunities for clients to make out-sized gains. Case in point:

“THINGS OVER PAPER” -

My summer 2020 theme of investing in INFLATIONARY ASSETS has continued to serve our clients well. I see no reason for this to change in the year ahead - and yes, that includes equities, but in particular investment in physical assets and commodities.

In November 2020, the big trend I recommended was uranium. I said it was a multi-year trend that was in the early innings. Five years later and it is a global theme of major importance.

In early April 2024, the big trend I recommended was precious metals. I said gold, silver and miners would be a multi-year trend that was in the early innings - for all kinds of macro & fundamental reasons. Less than two years later, it has become the #1 asset appreciation - easily outperforming SPY and Bitcoin, combined, on a 3-year lookback.

Every word from my April 5th, 2024 still holds true as rationale to hold gold/silver long:

Ironically, the chronic underperformance of mining companies is why they have been left-for-dead by many active traders let alone passive investors.

And that is likely why I am most excited about this sector.

Foreign Central Banks will not stop converting USD for gold as long as US is in Fiscal Dominance. Debasement of the dollar is bullish gold.

Gold is at ATH nominally, but not relative to USD. It has room to move much higher relative to history.

Central Bankers need gold (not gold equities) to circumvent USD, but gold/silver stocks will appreciate nominally as the underlying prices rise.

Gold & Silver chasers will point to the $35 to $850 gold run during the 1970s, when stagflation occurred in the US during an inflationary wave.

Investor expectations are currently extremely low for miners, which is a great set up for my mantra that Outliers Revert With Velocity.

But this theme of THINGS OVER PAPER was not limited to inflationary assets but prices in general - homes, cars, goods & services.

Rationale was simple: compounding inflation in prices would become entrenched.

Bears reminding that I’m not talking about the falling rate-of-change in inflation (CPI) or the Fed’s (silly) 2% “stable price” mandate. Both are full of gaslighting and was/is/will continue to be much noise over the signal of rising prices in goods & services; rising commodities - both industrial and precious; and rising inflation in THINGS that are impacted by compounding inflation and falling value of the dollar.

I’m also not talking about the potentially aggressive Fed rate cuts that try to pull the 10Y yield lower. My bet: global bond holders will see through this and price in the anticipated inflation from political rate cuts, unrestrained fiscal profligacy and resulting currency volatility.

Hence, THINGS OVER PAPER is a durable investment theme.

“BONDS ARE DONE GOING UP” -

Speaking of bonds... I was convinced 5 years ago that we had seen a bottom in the 10Y interest rate and made a bold call in August 2020 that bonds were done going up. At first, rising longer-duration yields was a function of rising inflation from massive QE as well as my bet that the sell-off in oil was extremely oversold in 2020 and not only would the energy trade be a durable rotation trade for all of 2021-2022, but that hedge funds would manifest their inflation bet by investing in the oil sector. This was a major call in March 2021 for crude oil to double in one year to $130. This rising inflation/yield/oil rotation proved especially prescient heading into 2021 and persisted into 2022 as crude topped in March 2022 at my $130 target and CPI peaked at 9.1% in June 2022.

My Jan 9th 2022 call that SPX would pull back 20% as bonds sell off was not only very public & very non-consensus, but one of my best macro calls ever.

On the flip side, knowing that policy intervention would be needed to stem the 35% selloff in Nasdaq (65% selloff in NVDA for example), as well as severe US & Japanese bond selloff, helped me time the turn. I literally posted: “Bond bulls NEED to defend here” right before live commentating the Japanese intervention in October 2022 as the bottoming event. A few months later, Matt King of Citibank said $1.5 Trillion of global central bank intervention entered in the span of a few weeks that October to backstop the currency, rate & equity volatility across US, UK, JAPAN & CHINA.

Fast forward to 2025 and Gundlach doubles down on his warning that long-end bonds aren’t buyable until the 10Y yield reaches 6%!

They have gyrated widely (3.6-4.8%) but settled around 4% since Fed started its rate cutting regime in September 2024 - fifteen months ago.

I see no reason short of recession for them to fall below 3.6% as term premia stays bid with inflation, despite the political expediency of the Fed to cut - even as unemployment rises and CPI falls.

In a nutshell, there is only one reason to own the long-end: recession (for a trade) or balanced US government budget (for a trend).

“FALLING GLOBAL OIL DEMAND” -

After my strongly bullish oil call summer 2020 - spring 2022, I turned strongly bearish in April 2024. The price of crude oil has in fact fallen from then $85 to my predicted range of $60-40 by end of 2025. As it turns out, WTIC has been firmly stuck in the $65-55 level most of this year.

I continue to see this auction of supply/demand put pressure on price as rest of world (outside US), migrates quickly to EV for transportation, corporate cost management and consumer savings.

The result of this migration to EV in China & India represents significant consumer stimulus. The rollout in Europe and Canada is growing. US is resistant - from the executive branch, to the entrenched oil & gas industry lobby, to the insurance companies that block affordability. But the winds of change are still blowing Westward and it will be felt in time.

The result will not only be global falling oil demand but a US Oil & Gas Recession of size that rivals 2014-2106.

Every time in the past 20 months I have voiced this extremely unpopular view, I have received strong pushback. But I’ve had that reaction a bunch of times on my highest conviction themes that take time to play out. To which I say:

The Market Doesn’t See It Yet

“MONEY GOES HOME” -

An early 2025 theme of falling USD has continued to serve our clients well as the debasement, de-dollarization and devaluation of the value of the US dollar continues - along with the continued softness in the demand & value of US treasuries.

This is not a call on the speculative positioning of US assets by foreign money, for which there is a strong presence (especially in AI stocks), but in the falling DEMAND for USD post Trump election & tariff regime.

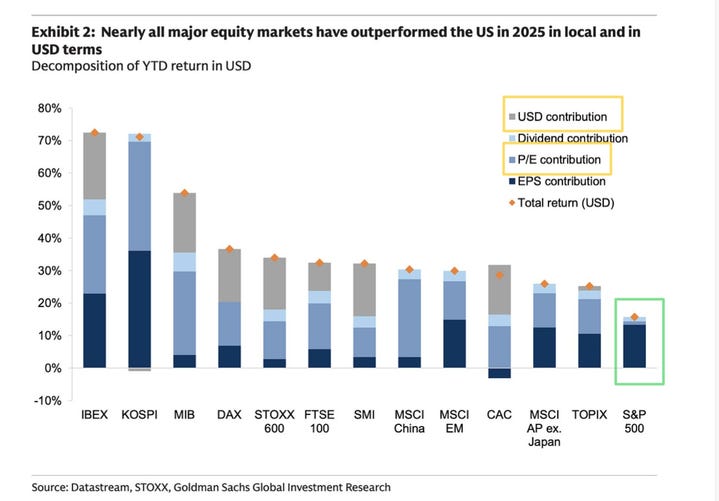

Have you also noticed the great returns in rest of world relative to US?

US is strongly underperforming ROW in 2025 as global easing - both monetary and fiscal - continues to attract money home.

And as China & BRICs nations settle trade in gold - outside the US dollar, US treasuries and US petrol-dollar (oil) - there is less demand for both dollars and treasuries of the US.

As further proof, Fed is starting yet another debt monetization program - specifically because foreign governments demand less US treasuries as supply of short-duration T-bills to fund rising US fiscal spending swamps the falling demand.

Dalio warns often that this is the backdrop for his book: How Countries Go Broke.

Then when you see ideas floated around (by Treasury Secretary Bessent) like taxing or cutting the coupons on foreigner bond holders or extending maturities, it only proves the point that we are getting closer and closer to big rate volatility, not further away from it.

That’s when MONEY GOES HOME BUT FASTER.

“RECESSION INTO ALL TIME HIGHS” -

US stock market is at all time highs. Consumer sentiment is at all time lows.

Translation: The real US economy is not participating in this inflation of assets and global equity advance, as US dollar debasement erodes purchasing power of lower-wage earners. It’s a double edged sword for the masses but double the pleasure for the elite holders of INFLATIONARY assets.

In addition, corporate earnings growth continues to get marked up on EXPECTED productivity gains... that ironically results in lower head count (read: layoffs). As such, stocks can continue their march (or melt-up) higher at the same time unemployment rises!

So what’s good for Wall Street is not good for Main Street.

Add to that, US government crowd-out - from direct investment in US companies limiting competition, to crony capitalism in the favored-few, to the higher borrowing costs of higher deficits that limits lending/refinancing for consumers and corporations alike.

At the same time, US government is shedding labor at a rate the private sector cannot absorb.

Claudia Sahm makes this point clear:

The unemployment rate was 4.6% in Nov 2025.

There are 982,000 more unemployed people in Nov 2025 than in Jan 2025.

There are 271,000 fewer federal government employees.

982,000 > 271,000. More than 3 times more unemployed.

Speaking of Sahm ...

The unemployment rate rose by 0.45 basis points from June to November.

Translation: we are closer to triggering one of the more famous recession rules of thumb - the Sahm Rule, named after Claudia Sahm.

Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.

This indicator is based on “real-time” data, that is, the unemployment rate (and the recent history of unemployment rates) that were available in a given month. The BLS revises the unemployment rate each year at the beginning of January, when the December unemployment rate for the prior year is published. Revisions to the seasonal factors can affect estimates in recent years. Otherwise the unemployment rate does not revise.

Recessions are historically characterized by rapid increases in the unemployment rate over a short period of time AFTER unemployment gets high enough to seriously impact consumer spending, which leads to businesses cutting back on investment and hiring. This triggers even more belt-tightening both in corporate boardrooms and at home.

Keep in mind, the US unemployment rate has slowly risen from 3.6% post covid to 4.6% (as reported, and not counting October). So the point is: once unemployment spikes, as the Sahm rule can warn is getting closer, it can pick up speed and with it the forced selling of equities.

Will equities front-run another 4.6% print in January for December?

That would take the Sahm rule to .53, which would pull forward recession risk and volatility/selling.

It would also motivate the FOMC to cut again in January.

Would this accommodative cut help to further delay a deeper growth worry?

Employment matters!! And the Sahm rule bears watching - closely.

2026 IS PRICED FOR PERFECTION

Wall Street consensus sees S&P ending the year with a strong return of ~16.5% or ~$7900 - the third highest expected 1-year return over the last decade.

Curious if this ignores rising unemployment and even if it is because of it (due to productivity from AI). Either way, 2026 is priced for perfection.

As such, US equities cannot afford a sustained macro shock like spiking unemployment - as both current valuations and expected returns reflect stable or even slowly rising unemployment.

Basically my RECESSION AT ALL TIME HIGHS tagline I’ve been using the past few months refers to this condition of a weakening labor market at the same time the expected AI monetization and productivity gains are pulled forward in stock returns.

But this elevated state is only sustainable as long as unemployment doesn’t run hotter than companies can monetize from AI!

And assuming that fiscal expansion & monetary easing pumps jobs not just inflation.

Place Your Bets!

WISHING ALL A FABULOUS WEEKEND, WEEK AND HOLIDAY!!!

Dear Mrs. Laduc.

This year is almost over, and many people on X's Fintwit are predicting that next year will be a difficult one. I've only been investing for a short time, but as I've become more aware of the market, I've learned how difficult it is to manage risk and succeed in that environment. It's even more difficult when you make it your profession, achieve results, and gain credibility.

Also, the market basically never rests, which creates even more pressure.

Even in these circumstances, your predictions are brilliant, and your occasional touch of humor is a welcome relief.

Your team is also very talented, and perhaps your personality attracts talented people.

I hope you have a wonderful Christmas and holidays, and please take care of your health.

I look forward to more fun posts next year. With sincere gratitude, I thank you.🥰🙏