2026: $8200 SPX, MALINVESTMENTS, AND MISPRICED EXPECTATIONS - THE WHAT IFS - PART 3

Review of My 2025 Predictions In A Nutshell -

2026 Bullish Consensus -

AI Mania Not Done -

$8200 Melt-Up Target?! -

Biggest Investor Blind Spots for 2026 -

2026 Malinvestment Themes -

Top 2026 Mispriced Expectations & Timing These Risks -

Climbing The Wall Of Worry -

Caveat: Before you dig in, please note this client post was written two weeks ago as part of my 3-part 2026 prediction series, and BEFORE the news this weekend of Trump entering Venezuela to remove President Madura and telling Americans that US will “run things” awhile while ‘taking back our oil” & other resource grabs.

Ironically, my MarketWatch article last week was based on the premise for higher equities on a USD that continues to fall from debasement, de-dollarization, devaluation. The intervention in Venezuela is nothing short of a currency intervention - but I will leave that post for another day.

Review of My 2025 Predictions In A Nutshell

Equity Price Targets:

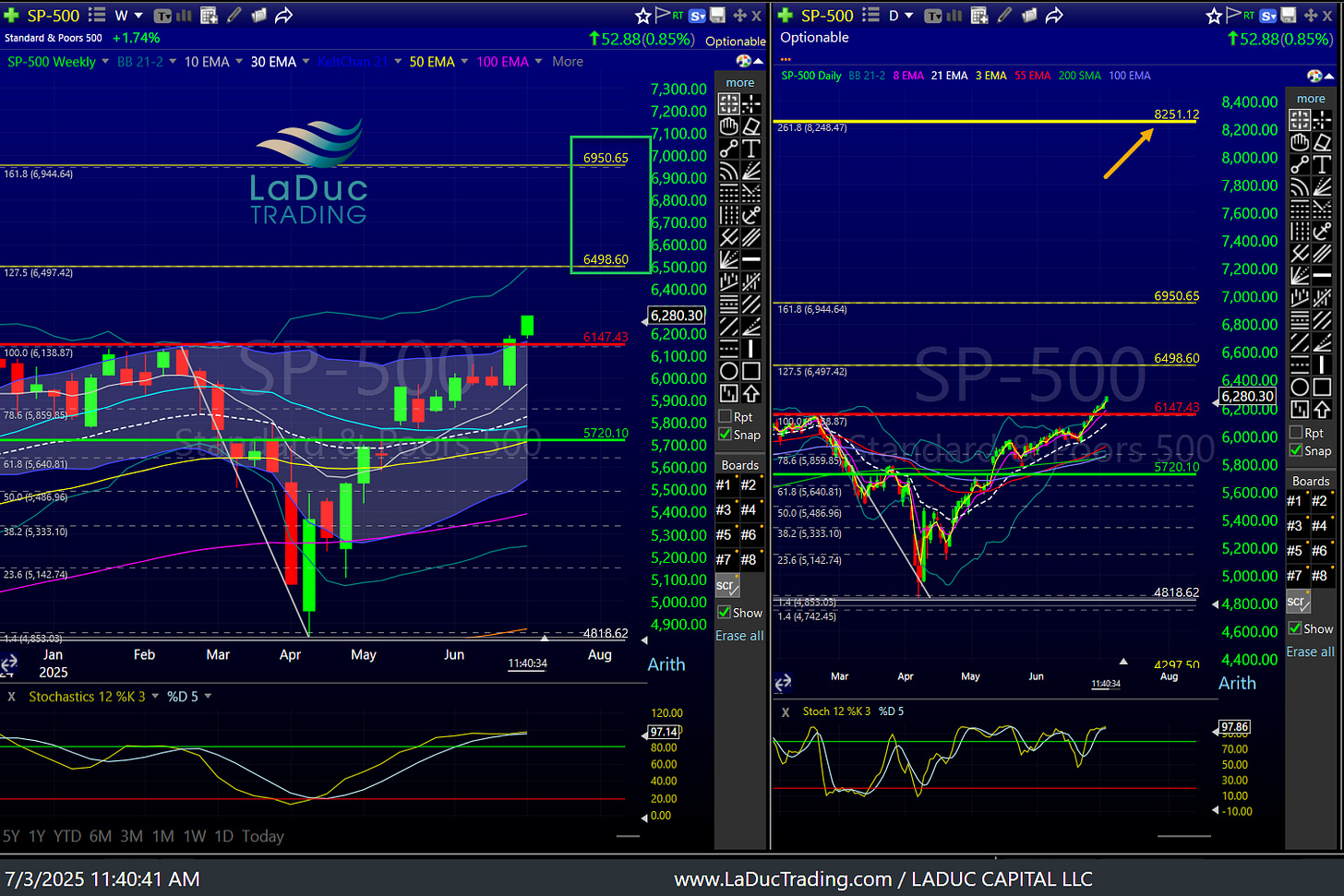

Warned clients JAN 3rd, 2025 near $6000: “No $7500 SPX Hat For Me” when consensus was giddy for higher.

Instead, I gave $4800 SPX target expecting a “bloodbath for stocks” in 1st half - which was a predicted 20% expected pullback. We got it.

Then April 9th at 1:15 PM ET my timestamped client post warned that Bessent & Trump gave the policy intervention that would put the bottom in stocks post Tariff Terrors. My intermarket tells confirmed higher April 23rd & I warned of May 12th “birthday rally” which we also got.

Market went straight up into my posted upside target: “Hellbent on SPX $6666” which we tagged in September.

Oct 29th I warned in a detailed post, “Too Much Of A Good Thing”, on expectations of chop into year-end from overly-excited bulls. Market fell 6% before rebounding to close the year at $6845.50.

Sector Highlight:

Gold, Silver & Miners were recommended as “monster sector rotation” play April 5th, 2024 with my special gold/silver ratio as “my most bullish chart of all” for a trend that “can last many months if not years.” Gold & Silver were the best performing assets in 2024 & 2025.

Updated my bullish precious metal call in June before the magnificent run-up into Oct and end-of-year.

In September 2025 I warned clients of incoming October volatility in precious metals. Gold had a 5-standard deviation move lower in October.

Guided clients all year for higher on all metal/miners within the commodity complex across Uranium, Gold/Silver, Platinum/Palladium, along with the Industrial & Base Metals of lithium, aluminum, copper, steel etc which are are still working.

Expected gold, silver & miners to chop sideways into year-end post October volatility. Silver had other ideas screaming higher while gold & gold miners closed at October highs after chopping sideways two months.

Macro theme for year:

“Long Stocks Equals Short Dollar” on USD debasement, de-dollarization, devaluation is still working big picture and why equities can continue higher big picture in 2026.

2026 Bullish Consensus

Let’s face it, consensus bulls are excited about equities for lots of reasons...

Easy money narrative continues - from an incentivized White House, Fed, Treasury & Congress.

Mid-terms - ensure some political incentives for voters to keep them in a good mood.

Fed rate cuts - aren’t just about what’s priced in but the potential for more as “bad news is good news” now.

Fiscal spending - from OBBBA impacts that juice corporate earnings to promised consumer stimulus checks.

Tax cuts - targeting the super wealthy & corporations to keep spending.

Investment Incentives - from government reshoring incentives to US Government As Venture Capitalist equity stakes in corporations.

Deregulation - to stimulate industries/banking for greater corporate profitability & investments.

QE Lite - Fed liquidity plumbing programs to ease REPO, SOFR & Money Market volatility.

AI productivity - gains & innovations benefiting corporate margins & (hopefully) society at large.

USD debasing - tailwind to US exporters/headwind to importers while real value falls as biggest reason to be bullish the US equity markets.

AI Mania Not Done

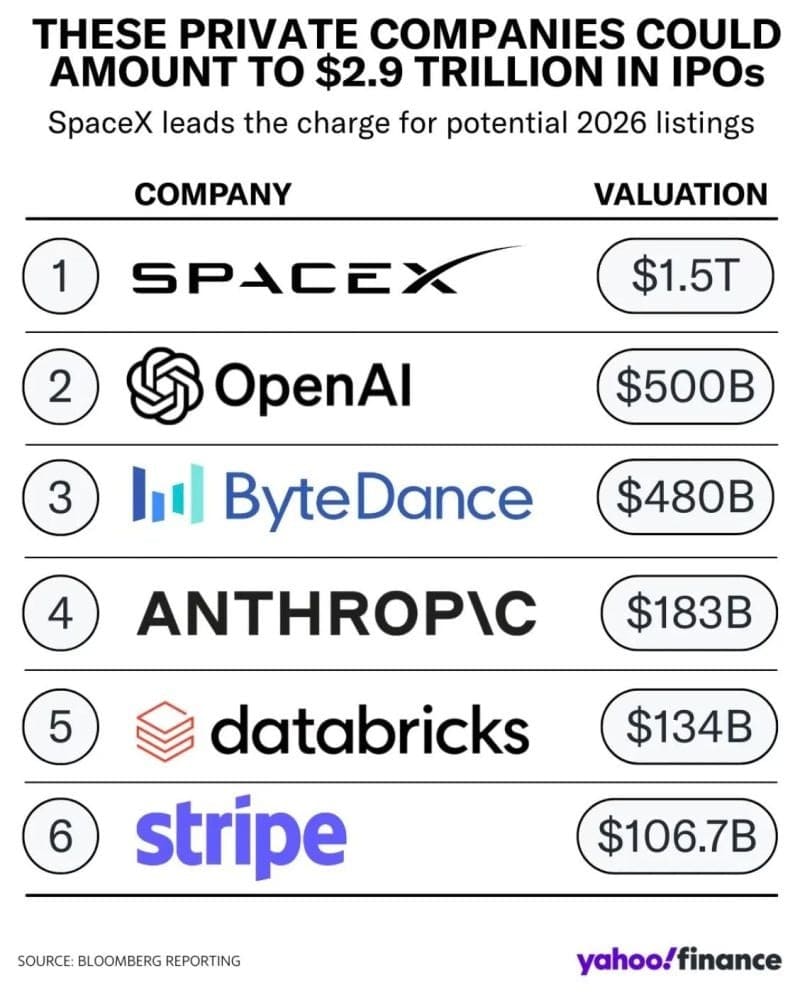

Before jumping on the list for bears, I would remind it will take a big macro event - like recession - to interrupt the bullish flows from the sentiment that is AI given so many major IPOs scheduled throughout 2026. That alone could make the argument that it will be very hard for the market to fall apart until big money has exited.

Then there are the Private Equity & Credit Bulls looking at the math of AI and these huge deals:

All SaaS revenue for 2024 was $260B+

Consumer digital goods was $160B+

~$1.2T of US wages are in tasks AI can technically perform today (est. by MIT Iceberg Project)

$60B is current estimated REVENUES from AI.

Ergo: There is a LOT of expected run-way higher in AI monetization that PE & credit bulls expect to extract.

$8200 Melt-Up Target?!

Given all of the above, given the potential for a continued grind or melt-up higher, all else ignored, it is clear to see why consensus equity bulls have $7500 as S&P target for 2026.

But the irony is that on that climb higher, AI productivity gains and margin expansion from AI monetization will most likely result in LAYOFFS!

Which is why I deem this AI market as RECESSION INTO ALL TIME HIGHS - where the labor market continues to suffer and inflation stays sticky but equities march higher.

FOMC is also calling for STAGFLATION as biggest risk to 2026 as they foresee rising inflation and rising unemployment at the same time. Market, has not shown signs that it cares.

But it is the Easy Money mantra and the USD de-dollarization, debasement & devaluation as the key reason why I gave: “If $6100 then $7000, and if $7000 then $8200” as technical breakout levels last summer.

Biggest Investor Blind Spots for 2026 -

2026 is priced for perfection. US equities cannot afford a sustained macro shock as both current valuations and expected returns reflect a very fault-intolerant market.

Spiking Unemployment, Yields and/or Inflation is not priced in. Recession risk can pull forward NDX concentration risk unwind, yen carry trade unwind... not to mention derisking in the equity growth narrative that freezes credit markets.

Expected Fed policy is expected to be politicized. The Trump Administration is pitching a productivity boom, falling inflation and emphasis on Fed lowering rates to stimulate growth. All of that bears watching as perception does not always match reality - especially into a contentious mid-term election amidst weakening labor market and a Fed that lacks consensus on expected rate cuts.

Liquidity cycle is slowing. The new Fed liquidity mechanism is dubbed “Not QE, QE” but in fact is really a plumbing mechanism to manage the money market, TGA, Repo, and SOFR volatility. It is not liquidity supporting to equities. They will need to rely on other forces to further climb the wall of worry.

Repo matters. I wrote about this at length in November:

A Rise in Repo Rates Matters to Liquidity & Collateral Values - In Everything - as Rise in Repo Rates (That Sticks) Can Trigger → QE (Fed Buys Assets) → Crack-Up (Equities) → Gold & Commodities Spike → Dollar & Bitcoin Crash.

2026 Malinvestment Themes

Given the current administration’s motivations, Trump & markets will continue to support malinvestment as a theme - as it too is seen as bullish.

Given the current administration’s motivations, Trump & markets will continue to support malinvestment as a theme - as it too is seen as bullish.

US Government as Venture Capitalist - All For Me & None For Thee...

The US is way behind China in all the ways that matter to physical dominance of supply chains for national security purposes.

I wrote about this in January 2025 adding China’s “AI Tech Dominance” post DeepSeek: THIS IS THE MANHATTAN PROJECT 2.0.

Americans are now realizing how dependent we have become as the debtor nation and this gives cover for Trump to use this sentiment to have the US Government invest DIRECTLY in companies here and abroad. That had ended in the 1950s - before Trump entered office.

This form of ‘capitalist capture’ puts US in the precarious place of trusting Trump & his administration to choose wisely where to invest US taxpayer money.

The lack of transparency and insider trading that is prevalent hurts trust and innovation.

Investors believing in their stories of gaslighting around manifesting a deglobalized supply chain domestically only makes the reality worse.

The grift from Trump loyalists and pay-to-play corporate kick-backs will produce very little in value for American’s strategic benefit.

Investing in The Con (bitcoin, crypto, stablecoins) that artificially backstop US Treasury demand so that Trump/Treasury/Congress can appropriate more malinvestment in public/private equity equivalents only puts US deeper in debt - financially and morally.

The Con - Crypto, Bitcoin, Stablecoins...

This is an ‘asset’ class of grift and offramp for sound money - used for speculation by those in greed (with few benefits/circulation by those in need).

It is an inflation decoy - mistakenly viewed as a commodity when it is closely tethered to our falling USD.

As a mistaken source of value, it siphons money away from actual investment in real things - people, industry, projects - that serve a purpose of enhancing real economic output and distributed rewards. It is a dangerous substitute for real investment - with no store of value or industrial use like gold, silver and related industrial and base metals.

Blockchain is different, as it consists of the new ‘rails’ in this new frontier of digital money. (More on this in the New Year!)

The Capex Craze - AI Datacenters & the AI Energy Conundrum...

The intensity of investment into datacenters before the energy source is built out is a symptom of the AI mania disease.

The WINNER TAKE ALL Silicon Valley drama that pins OpenAI Vs Google and Nvidia Vs China are examples of the mania as well.

This ‘next best thing’ in AI is certain to create big winners & losers - while the concentration risk in this MONEY BUBBLE drives hopes of harnessing & monetizing AI for maximum gain. But like many manias, it creates a mindset of CAPITAL AS DISPOSABLE that skews risk/reward odds as history has shown repeatedly.

This ‘next best thing’ in this Capex Craze is certain to create displaced workers in further support of my RECESSION INTO ALL TIME HIGHS theme, where Wall Street thrives as Main Street continues its dive.

Top 2026 Mispriced Expectations & Timing These Risks -

Complacency ignores the margin of safety needed to navigate a year where 2026 IS PRICED TO PERFECTION. With that, here are a few macro event risks that bear watching.

Jan/Feb government shutdown and spiking unemployment risks.

April/May Fed Chair & FOMC governor changes and the instability it can bring to currency & rate volatility.

Oct/Nov Mid-term election that delivers GOP turnover and the impacts from a Trump lame-duck presidency.

But the bigger macro triggers to time are the known-unknowns:

‘Money Goes Home’ thesis can trigger Asia selling equities to repatriate yen, won & yuan back home - triggering yen carry trade unwind round 2 and further NDX selling.

Sentiment on the AI productivity boom narrative can dissipate at any point - like around NVDA earnings or China reunification with Taiwan.

USD weakness can trigger on appointment of dovish Fed chair and rate cuts as easily as USD can strengthen as financial conditions tighten from falling global credit demand.

Crack-up boom in equities can trigger from a strongly falling dollar that triggers aggressive rotation into commodities that triggers aggressive inflation spike and recession risk.

A wave of volatility can trigger liquidation events in both equities & commodities from forced selling on growth scare.

Government spending amidst lower rates and tariff stabilization may not lift domestic demand or spur net positive exports (despite falling USD, regulations and corporate taxes). Rate cuts on economic growth disappointments and labor weakness may not stimulate demand and investment.

Refinancing pressures from higher rates (despite monetary easing & liquidity infusions as bonds fear inflation from dovish Fed) can trigger USD funding stress.

Compressed credit spreads can mask quality of credit risks, as rising equities mask falling value and global demand of UST collateral.

REPO volatility delayed from Fed liquidity can give way to spreads widening. Global conditions can tighten (despite dovish new Fed chair) as US dollar funding shortages emerge from refinancing pressures & REPO risks.

‘Trade War turns Capital War turns Military War’ can happen at any point.

IF only goldilocks was a sure thing you wouldn’t need year-end predictions!!

Climbing The Wall Of Worry -

Markets rise ~80% of the time & fall ~20% of the time.

As I like to say, macro event risks are needed, therefore, to interrupt the bullish flows & sentiment.

With that, the biggest reason market can continue to climb the wall of worry in 2026 is because geopolitical escalation AND economic growth risks stay muted. Otherwise…

Productivity, Wage Growth and Real GDP Growth - can they outpace inflation?

Commodity inflation is the risk as is falling US Treasury demand.

Employment in private sector - can it stabilize AND absorb labor shedding in government sector?

AI Capex spending slowdown is a risk as is AI monetization/demand disappointment.

Dollar & Yields (& Oil) - can they stay range-bound and not have any sharp moves?

Recession is a risk as is European recovery faltering as is Japan advocating for regional isolation & conflict.

Equity rally broadens - can low-beta, big-and-mid-cap value stocks get supported as rotation out of AI mania is gentle not severe?

US Govt Crowd-Out is a risk as is concentration risk that stifles private Innovation/Investment/Employment.

Government invests in productive uses of money - can we really expect government policies drive production & consumption, reducing debt and interest expense?!

The US Monetary “Bullwhip” is a risk as are higher rates & USD funding stress.

Lawyering this bullish-bearish trade is a daily exercise for me and I’m grateful for you joining me in this journey of discovery and What-If risk management!

We will navigate all the twists & turns live in my trading room together. See you there!

With that, you have my thoughts on the year ahead:

Let’s give every New Year our very best, and it will give it back!

Thanks for being here, and Happy New Year!!