2025 PREDICTIONS REVISITED

Game of Chicken In Play.

“No $7500 SPX Hat For Me”

A quick reminder that I sent to clients JAN 3rd:

"Medium-term, my technical analysis read is that SPX 6100 -5500 is but a channel where we could digest awhile...with 4800 MASSIVE support."

Given most are now laser-focused on that $4800 level all of a sudden, I thought it might be timely to remind.

But even before that 2025 prediction, on NOV 26th I posted these market thoughts: No $7500 SPX Hat For Me - which I have UNLOCKED today:

I made this prediction because the animal spirits were getting active again on the Trump Bump post election, and the 2025 S&P 500 price targets rolling in for the start of the year were getting silly.

In the above post you will see where client Anne asked me if I would buy ANY of my current Trend longs breaking into ATH, to which I answered & posted above:

"No. Because I expect 2025 to be a bloodbath for stocks".

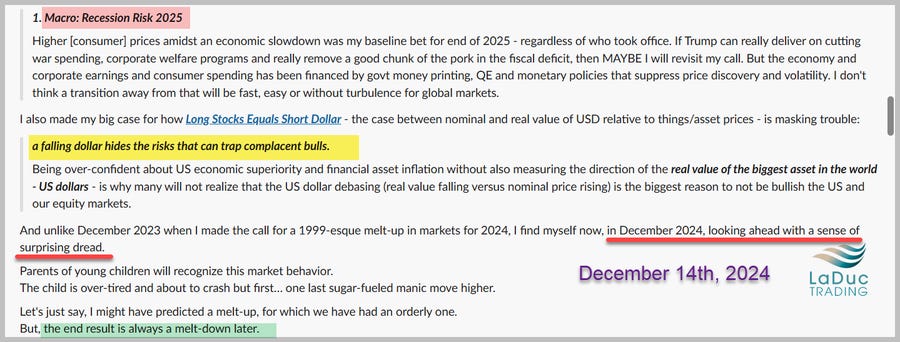

I also refer to my 2025 Predictions posted DEC 14th...

TOPS ARE A PROCESS; BOTTOMS ARE AN EVENT

Last week I updated my intermarket-tells post quarter-end for CLUB/EDGE clients to see if buyers had stepped in yet:

INTERMARKET ANALYSIS - WEEK ENDING MARCH 28, 2025: TOPS ARE A PROCESS

PRIOR WARNINGS:

After my recommended short Feb 19th: INTERMARKET REVIEW MARCH 7, 2025: CONTROLLED SELLING

Then… INTERMARKET REVIEW MARCH 10, 2025: BUYERS ARE STILL STEPPING AWAY

Even after an expected bounce: INTERMARKET ANALYSIS MARCH 14, 2025: BUYERS HAVE YET TO RETURN

AND my “bull trap” warning: INTERMARKET REVIEW MAR 21: YEAR OF VOLATILITY STILL MY BET

As I have been warning for months, buyers have just not stepped in!

My March market-thoughts client posts reinforce this theme:

5th: MONEY GOES HOME

7th: CONTROLLED SELLING

9th: VOLATILITY IS NOT DONE

11th: THE STRATEGY OF CHAOS

10th: BUYERS ARE STEPPING AWAY

14th: BUYERS HAVE YET TO RETURN

16th: MARKET SELL-OFF IS FEATURE NOT BUG

21st: YEAR OF VOLATILITY STILL MY BET

23rd: THEY'RE NOT HEDGING. JUST SELLING.

27th: BALANCE OF TRADE IS THE END GAME

28th: APRIL 2ND IS UNDERPRICED RISK

Today I am working on the BOTTOMS ARE AN EVENT post and what I'm looking for specifically to stabilize markets - other than that $4800 SPX handle. ;-)

But my point is this: When oversold STAYS OVERSOLD it is not time to buy.

Case in point: h/t @TheShortBear & @Marlin_Capital

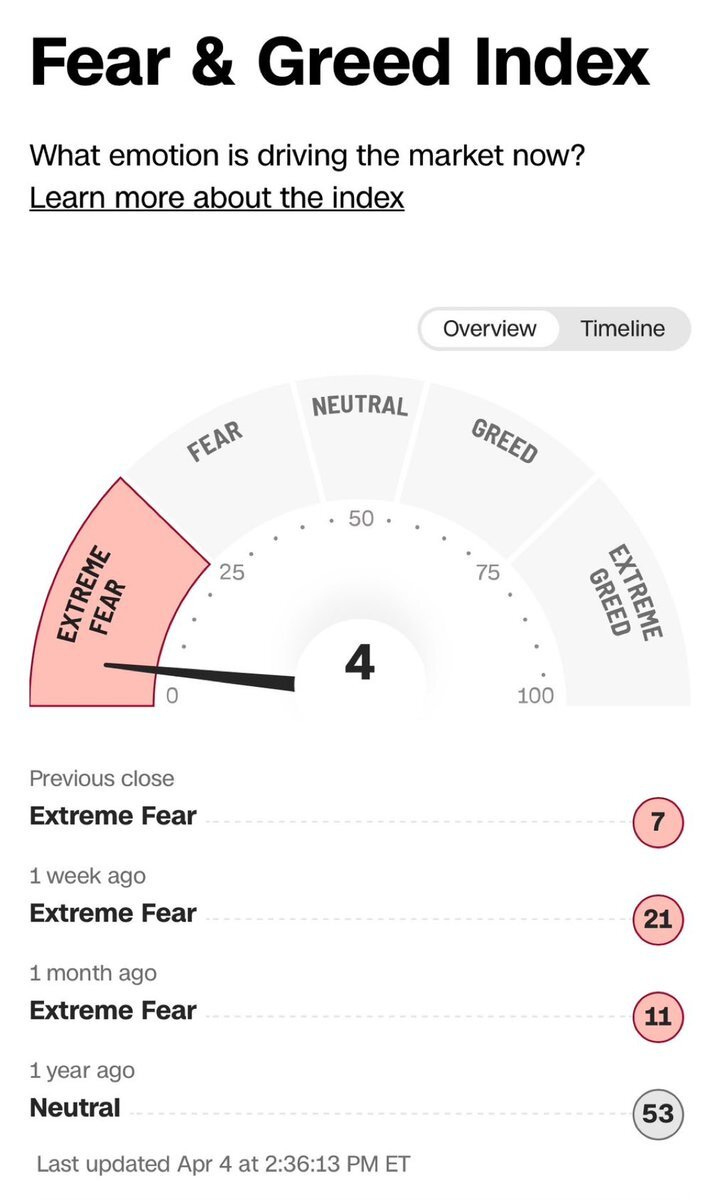

CNN’s Fear & Greed Index has been in “Extreme Fear” for the entirety of this -17% $SPX correction.It was at Extreme Fear 1M ago (11), and the $QQQ is down -15% over the last month.

SIGNS OF SELLING EXHAUSTION

I started warning a few months ago that Macro & Fundamentals have been driving while Option Dealers & Sentiment have taken a back seat.

What helps me navigate ALL? My intermarket analysis. And I can tell you - and hopefully it has helped you navigate since early December:

1. DEC 2: Buyers have stepped away

2. FEB 19: Sellers have stepped in

3. MAR 14: No buyers despite green shoots

4. MAR 26: Sellers have stepped up

5. APR 2 after hours - now: Buyers aren’t even thinking about thinking about stepping in.

But we are getting SIGNS OF SELLING EXHAUSTION.

With that, I have updated my Friday April 3rd client post re-assembled & edited above for better viewing and have included these FINAL THOUGHTS…

IT'S NOW ALL ABOUT THE TAX CUTS & DEBT CEILING PASSING

MONDAY GAP DOWN is the bet for many traders - ala Aug 5th, 2024 or even 1987!

But I contend: market won't bounce UNTIL Trump gets his tax cuts!

Then today/Sunday:

Bessent doubles down: Tariffs WILL stay in place.

Lutnick doubles down: Tariffs WILL stay in place.

My bet is this STRATEGY OF CHAOS will stay in place until Trump gets his TAX CUTS & DEBT CEILING RAISE.

Bears reminding:

DEALERS/MARKET MAKERS & TECHNICALS ARE NOT IN CHARGE; MACRO & FUNDAMENTALS ARE!

When I wrote STRATEGY OF CHAOS for clients a month ago, I expected Trump would follow through on Tariff threats & his orchestrated confusion would pull recession risk forward.

Yes, he knows many US Large businesses, but especially Small-Medium Enterprises, are HIGHLY dependent on China. But this is his window for change & it’s Go-Big-Or-Go-Home time to negotiate all he wants to negotiate - internally and externally!

It’s why I have been warning early & often he would “pull recession risk forward”.

NOW?

Now, most are on the recession risk vibe as MONEY GOES HOME, corporate & consumer sentiment is in the toilet, labor is being shredded in the govt ecosystem at an alarming rate, stagflation is here, and Fed/Treasury Policy Interference is no longer assured.

A whole new world for investors & traders. And yes, a dangerous one. But strangely I’m not worried. What has changed for me since my dire warnings beginning of the new year?

Since last June when I predicted “recession risk gets pulled forward in 2nd half 2025” no matter who was elected - then again in Dec saying Trump would only pull it forward quicker with tariff threats - the whole time (in interviews + articles), I ALWAYS used the words very very selectively and consistently: “PULL RECESSION RISK FORWARD”

RISK is perceived not reality.

Pricing it in quickly is what markets have done as they have muscle memory from COVID.

But… I have also been repeating that Trump’s #1 goal is to get his tax cuts & debt ceiling through.

And tariffs are a GREAT internal political tool to use to get needed votes.

Are we out of the woods big picture? HELL NO! I have posted my 2025 Predictions in Dec that 2025 IS THE YEAR OF VOLATILITY which means waves of it. All year! Not one-n-done. (Yes, I have charts for this - it’s not sentiment based!!)

Anyway, I’m less stressed-out than many because I really think this is going to plan: to cause maximum chaos all to get his tax cuts… because if he does, we have no new net gain.

But if he doesn’t… US will plunge into ACTUAL Recession quickly.

Yes, tariffs-as-leverage can go sideways quickly for sure, but so far, this political posturing to get permanent tax cuts across the finish line needs to play out before markets can repair & our economy with it.

And now what in the world is going on with the usdjpy one wonders- still below 147 but only just. Given how much equities keep tanking one would have thought the pair being given to at least two big figures lower. Safe haven likes Fondue over Ramen I guess !