Part 1 of 3: TRADE ROUNDUP

Let’s go back before we go forward…

SOUN, INOD, PLTR, AI, GTLB and APP - My September 21st published report was well-timed.

Of the 6 names I said the weakest are GTLB & AI. Yup.

The strongest in chase mode were INOD (+29% since)

& APP +12% into 726 (hit) before falling back to $511 (en route, it tagged $545 Mon premarket)

My favorite swing long SOUN (just starting? +10%)

& PLTR for pullback to 172 - 161.40 (en route) before considering long.

AAPL, TSLA, ASML - My Tech Trifecta all worked as advertised from September 11th updated on the 22nd:

AAPL ✅that worked!

TSLA ✅ tagged 479.44 premarket Oct 2nd before a sharp pullback we also caught live from 470 to 430 chase short. 🔥

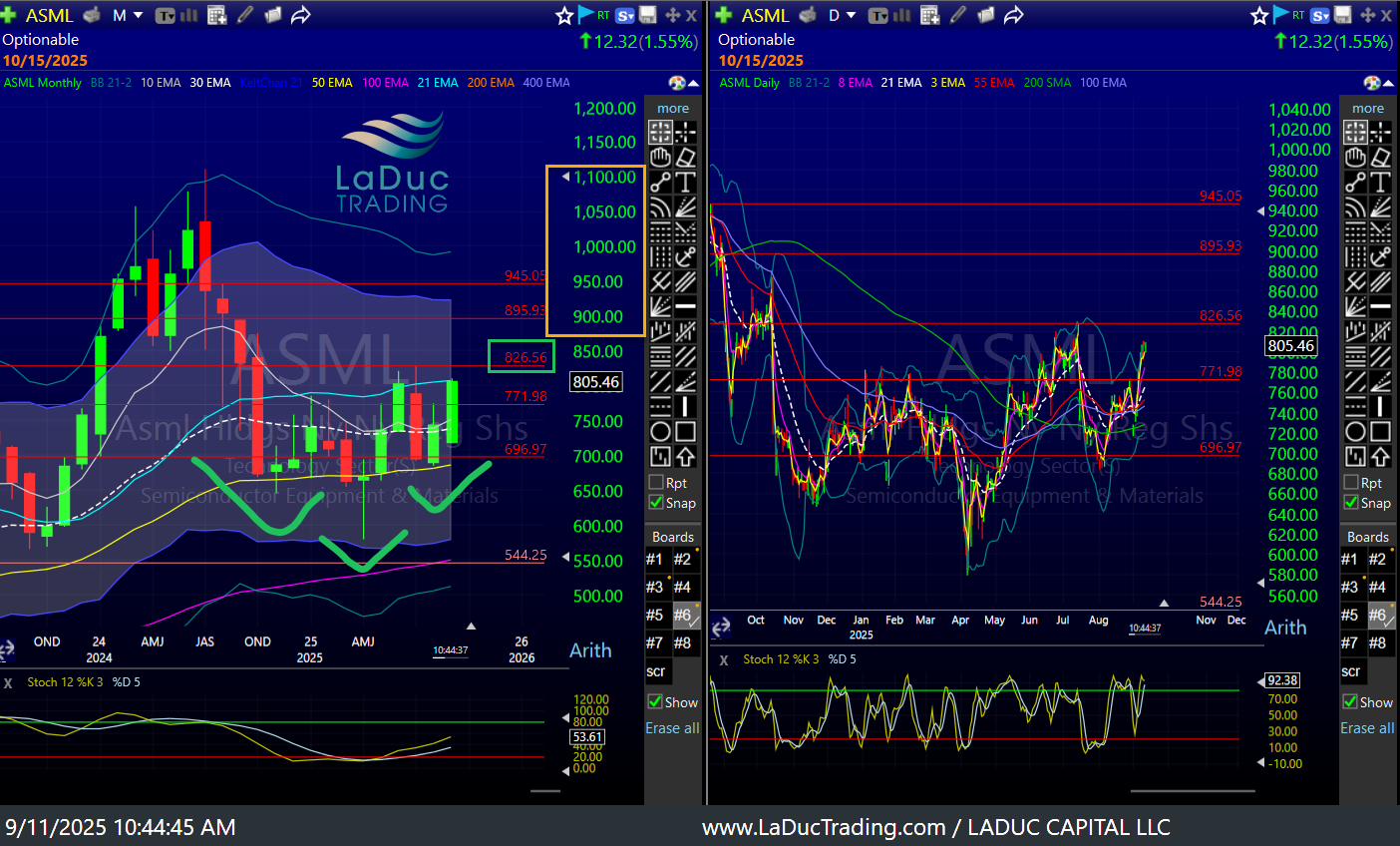

ASML ✅not only moved to my $1K target but then I warned that $1056 monthly resistance would likely see rejection. ✅

I mean, look at that oversold, strategic chip fab player just itching to explode higher after ONE YEAR OF BASING! Did I waste client’s time recommending before Sept 5th? No I did not - saving a lot of frustrations & wasted option premium from non-directional chop. My timing was spot on - and it is likely a great buy on a dip back to $896.

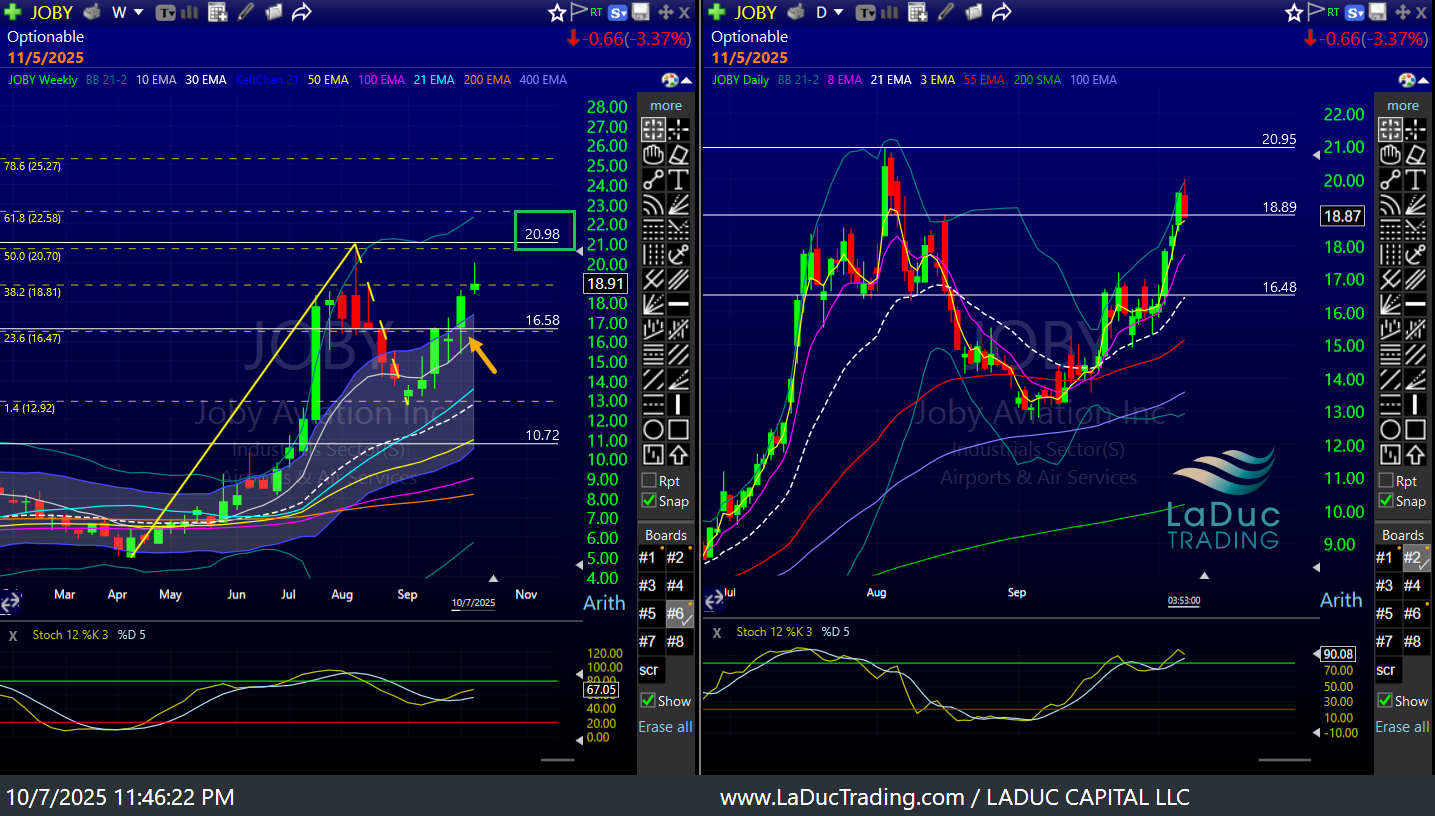

JOBY - also working higher with RCAT, RGTI, RKLB & SOUN - as positioned in my September 23 client post:

SATELLITE/SPACE TREND LONGS EN FUEGO

ASTS - Recommended in Feb of this year is on its way to 161.8 Fib level on weekly ~$78 so more than a triple on the underlying stock. Or more if you followed with my option tactics for scratch:

The JAN ‘26 financed call spread +30,000%

The JAN ‘27 bull risk reversal +60,000%

THANK YOU SPACE MOB 🤣😍😘

RKLB - Was also updated in last week’s post with ASTS and UFO with $62.70 highlighted (also 161.8 Fib level). We will hit that this week.

They should both digest soon, meaning sideways but that doesn’t mean they will.

Wednesday Schedule:

9:15 - 10:45 AM ET Live Trading Room

11-12:30 AM ET Gamma Prime Spaces